Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 7 minutes. Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives, so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

If you want to go straight to the predictions, scroll to the end. If you do, though, you are going to miss all this:

Did the Fed just blow up the bull market?

Insights from a money manager you’ve never heard of but will soon be part of your weekly feed.

Mind blowing insights about the fraud that is central banking.

How the ‘Twitter Files” were just the tip of the iceberg.

A taste of what’s to come in 2025 for MacroMashup.

The Fed - What Did They Do?

On Wednesday, the Fed threw some shade at the market, and the market pouted.

There were no real surprises: they reduced the discount rate by the expected 25 basis points. What annoyed the market was the suggestion that they may not cut as much as they initially thought they might in 2025. The so-called “dot plot,” where each Fed governor votes anonymously for how many rate cuts they expect in the coming year, suggested two cuts next year versus the four that had been discussed previously.

It reminds me of this:

The words “puke”, “plummet” and “rout” were trotted out in response to a ~3% drop in the S&P 500 and a rise in the 10-year Treasury from 4.40% to 4.50%. Hmm.

Jerome Powell suggested the market would have to adapt to living with uncertainty and indicated the Fed would remain firmly “data dependent.”

There is evidence that Powell managed some internal dissent among the Fed governors: the price of consensus on cutting 25 basis points was projecting hawkishness in the overall message.

My Take: The Fed should stop manipulating the market by controlling the discount rate and let the market determine interest rates throughout the curve.

Just as when the Fed moved rates down by 50 basis points earlier this year, and the 10-year yield moved up, the long end moved up again today - in defiance.

The market needs to wean itself off Fed-speak. It’s terrible at predicting the Fed and, perversely, gets angry when it gets it wrong.

For a considered view on all this from the “Fed Guy,” Joseph Wang, click on this interview with Forward Guidance. The meat of the rate-cut discussion is between minutes two and 33.

- Great Money Manager You Should Check out

I listen to Lance nearly every week on

’s Thoughful Money podcast. He’s a money manager, so he has no choice but to allocate the capital he’s responsible for.He doesn’t have the luxury of having smart opinions in both directions. Nor does any investor, including me.

Click on the bull above to see Lance’s daily commentary for December 18th.

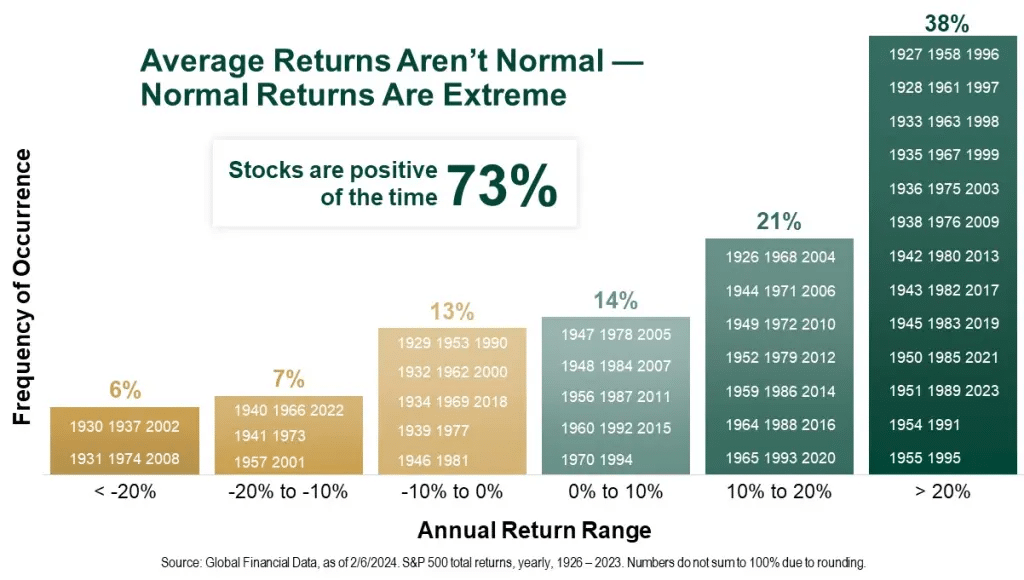

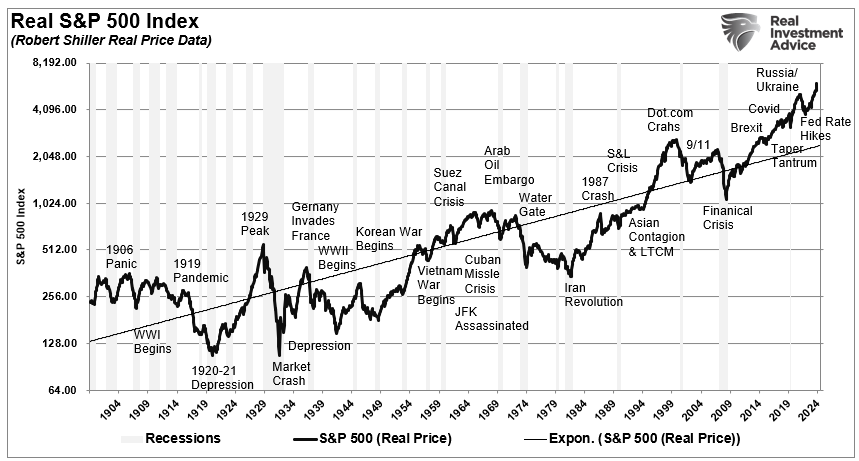

Here are a couple of charts produced by Lance that set the context:

My Take: The fact that stocks are positive 73% of the time is an excellent boost to investing confidence. But timing is everything; you get killed if you start and finish at the wrong times.

Lance may be talking his book as an active money manager, but I am hearing from many sources that passive investing will not serve you well for the next few years. Stay tuned for how I think you should navigate this.

Luke Gromen and Robert Breedlove - Mind Blown

Luke writes a newsletter I read every week. The research is excellent.

In this interview, he explains what he has been saying for the last two years. It’s a long podcast, so I recommend listening to it at 1.5x.

My Take: Since 2008, major central banks have injected over $25 trillion into the global economy, of which the Federal Reserve has printed over 25%.

Money is typically a proof of work: energy spent, gold dug out of the ground, Bitcoin mined by computers, and work done by employees. The price signals given when that money flows around the economy help allocate efforts and resources.

Everything gets distorted when the Federal Reserve prints money without any work attached. Breedlove and Gromen discuss how this has happened and how we can escape this mess. It’s a great way to pass the time when driving across Nebraska…(my last week’s project).

Mike Benz - This Guy Never Sleeps

Who is Mike Benz? During the first Trump administration, he served as the deputy Assistant Secretary for International Communications and Information Technology at the State Department (why are government titles so long)?

He has spent many years going deep into the rabbit warren of misinformation perpetrated by government departments.

It’s not just the Twitter Files. It goes much deeper and broader.

My Take: Information shapes how we understand the world. It is the oxygen that markets trade on. Benz’s case is that 2016 marked the start of a multi-billion dollar “whole of society” initiative to counter misinformation. It has reached deep into our educational institutions and our news media.

I talked about one aspect of that here:

Unless we want the blue pill, we must be careful what messages we believe (drones over New Jersey, or drones everywhere…)? Click the image below if you want more on blue pill-red pill.

Broken Money - A Book For The Ages

I am teasing one more thing this week. It’s a book review of Broken Money by Lyn Alden. I read it in two days (driving, Audible). Click on the image below for a thread on X.

Over the next few weeks, I will introduce a paywalled section open to premium subscribers only. I will let you know what that means…soon. It will include more in-depth looks at things I think you will love. Think of this thread as an amuse-bouche!

Takeaways

Passive investing is not going to work as well as it has for the last 15 years. Know what you own and why. Check your strategy and be thoughtful about buy, sell and hold if you DIY. Talk to your advisor if you have one. If you don’t, check out

.The market is full of worry and contradictory views on overvaluation, inflation, tariffs, and geopolitical issues. Pay attention and watch for major shifts in market sentiment, but don’t trade on emotion.

Concerns about the overall market going nowhere over the next few years do not mean the whole market will do poorly. It will be very sector- and company-specific.

We are reopening the Stibnite mine in Idaho because China is cutting us off from critical minerals—this will be a recurring theme: making and mining stuff here.

Minerals, energy, and companies supplying the electric grid will do well.

Gold and Bitcoin will play tag and compete for the hedging role.

Bitcoin will start 2025 above 100k and end at nearly double that, according to Jan VanEck, whose company offers a Bitcoin ETF called HODL (aka hold on for dear life). I think the Overton Window on the role and purpose of Bitcoin is shifting - it’s worth spending some time to educate yourself. It’s not just about “number go up.”

Write an investment policy statement for yourself:

Where do you want to go with your portfolio - what does it need to do for you?

How much risk can you take while still sleeping at night?

How are you going to implement this?

60-40 won’t work anymore.

The new paradigm is 30/30/30/10:

30% short-term fixed income

30% value stocks

30% hard asset - real estate, gold, Bitcoin

10% trading

Since this is the last newsletter before Christmas, Happy Holidays to both hemishperes!

Another great newsletter, thanks Neil