Methadone for the Markets - We're Addicted to our Central Bank

Not Everyone Agrees With Forgiving The Debt

Fiscal Stimulus Is Always The Most Powerful

I said I was trying to shift the Overton Window on discussing this. I still am.

We have seen inflation from the fiscal stimulus injected during and after the pandemic.

In trying to do its best to respond and protect the population from ‘excess deaths,’ the Trump administration and then the Biden administration decided fiscal stimulus was needed.

This was fair because some of the economic distress was caused BY the government.

Shutting down the economy, destroying supply chains, and pumping up demand with fiscal stimulus was a recipe for inflation.

Covid relief spending totaled ~$5T between the two administrations.

The Fed Stepped In, Too

In addition, the Fed made over $2T available through quantitative easing and other means.

The Fed’s primary concern during Covid - as it always is - was to keep the financial markets functioning.

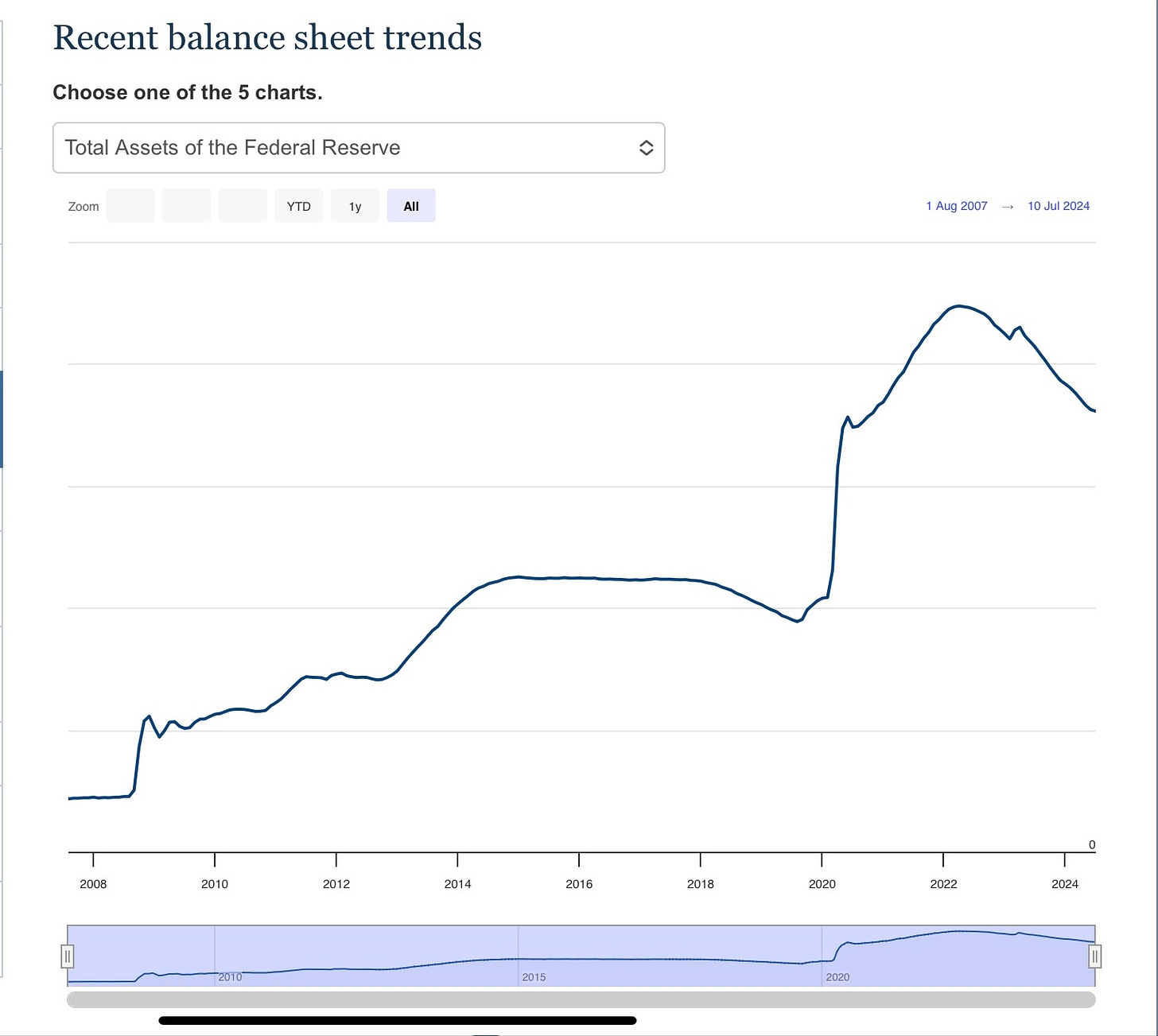

Its balance sheet increased from $4T to $9T. It would have been disastrous globally to have dysfunction in the Treasury market.

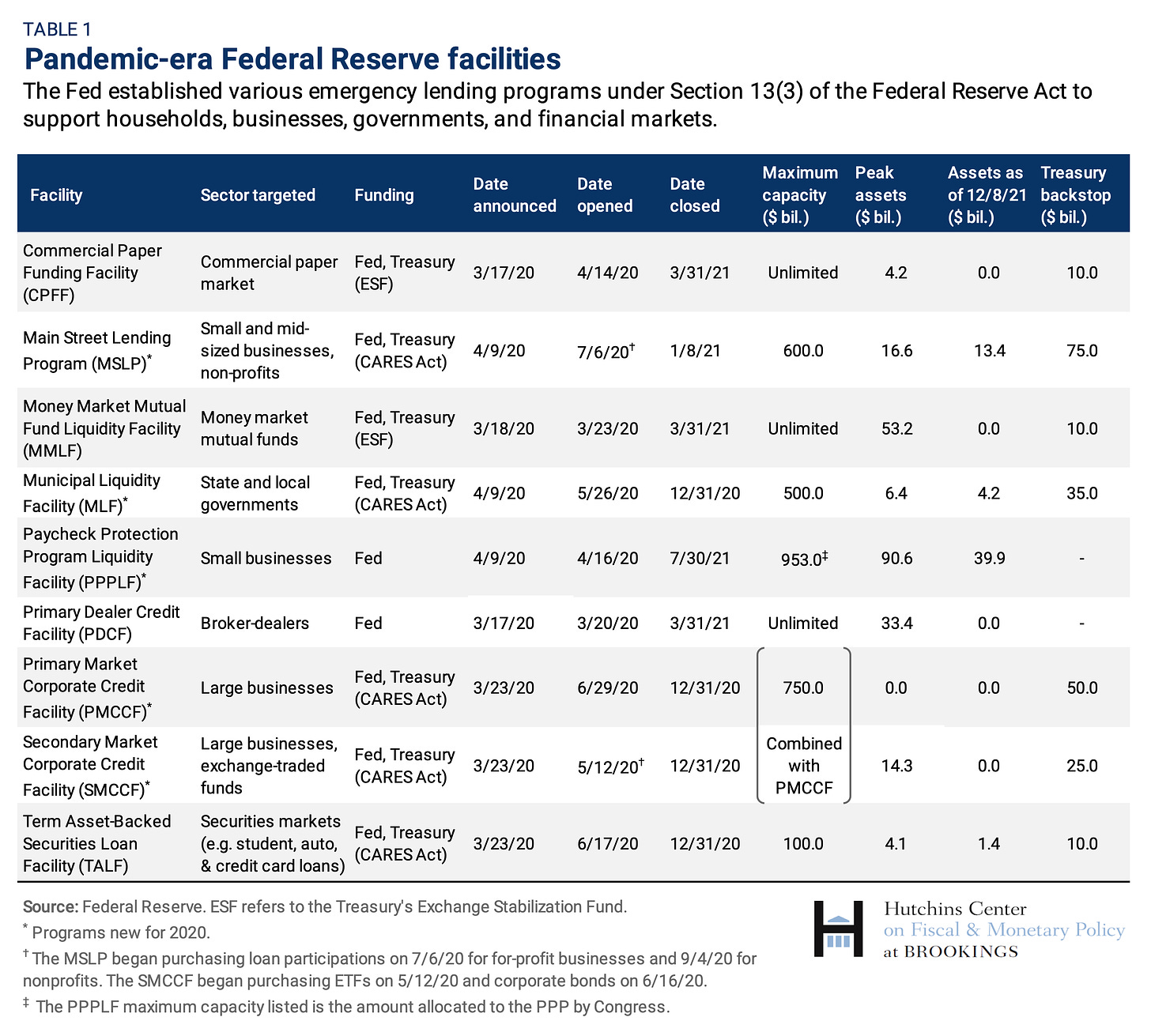

When the Fed takes emergency action, in addition to liquidity, it usually fires up a raft of programs targeted at different financial market participants.

In addition to monetary measures such as reducing the Fed Funds Rate to zero, increasing the rate at which it bought securities from the market (Quantitative Easing, or QE), and giving the market guidance as to future policy response (Forward Guidance), it instituted a whole list of new acronyms:

The global financial crisis (GFC) required similar action.

It’s Always About Liquidity

All these programs were designed to ensure that motivated buyers were present during a time of extreme nervousness about buying anything.

If no one wants to buy, sellers become distressed, prices drop, and panic ensues. The markets become irrational.

What does it mean when the Fed offers liquidity?

It means the Fed signals that it is prepared to act as the buyer of last resort: no one wants to buy? The Fed will buy at a good price, and then people will feel good about buying.

What does foreign exchange intervention mean?

The Bank of Japan (BOJ) has intervened to support the Yen three times this year. The Yen has been suffering from a prolonged period of low interest rates.

The BOJ has been operating something called yield curve control (YCC). Its purpose is to ensure that interest rates remain at or close to zero.

It has bought nearly 40% of all Japanese Government Bonds to do that. The result has been a weak currency. No one wants to invest in a market where interest rates offer no return.

The only way to entice investors is to make it cheap. A weak currency makes it cheap.

A weak currency is great for exports but makes imports expensive, leading to more inflation.

At some point, the BOJ decided the weak currency had gone far enough, so it bought a vast quantity of Yen. This year, it has spent ~$80B on Yen. It doesn’t advertise its intervention, but it leaves a lot of footprints.

That tends to push the currency up, at which point the BOJ looks smart: They just bought something cheap, and because they did so, that something went up.

It’s like Roaring Kitty buying GameStop and going on YouTube to hold a rally that talks up the price of GameStop.

All the ‘toxic’ securities the Fed bought during the GFC, at the point where no one wanted to buy anything, were housed in three vehicles—Maiden Lane I, II, and III.

They bought over $70B and made a lot of money— ~$12B for the American taxpayers.

Did The Fed Make Money This Time?

The Fed purchases during Covid totaled ~$4.6T (see how we went from B to T in 12 years?).

Whether the Fed makes money on these is not the point. They may or may not. They probably will.

They are playing with house money - your money and mine.

The Fed tends to create incentives for specific behavior in the market.

We will come back to incentives.

Addicted To The Fed

One of the lessons we learn from Austrian economists such as Hayek and von Mises is that, generally, we should crowdsource the allocation of capital resources to the free market.

There is wisdom in allowing individuals to make a million decisions about how they act in an economy.

Crowds can, in the right circumstances, show more wisdom than the smartest individuals they comprise.

The fate of communist economies and central planners ought to have taught us that leaving grand planning to a few people in the government is not the best recipe for successful outcomes.

The words ‘taper tantrum’ tell us a lot about where we are with the Fed.

The phrase, taper tantrum, describes the 2013 surge in US Treasury yields, resulting from the Fed’s announcement of future tapering of its quantitative easing policy.

The Fed announced that it would reduce the pace of its purchases of Treasury bonds to reduce the amount of money it was feeding into the economy.

Bond yields rose in response.

A whole generation of investors has become conditioned to ‘buying the dip.’

Every time the market sells off, the mindset has been to buy, with the near certainty that the Fed will make things right and keep the party going.

This has not been a bad strategy: the S&P 500 is up 449% since 2008, an annual return of 10.93%

But Now We Have Some Strange Incentives

I sent my last article to a friend and neighbor who responded that, while not really an authority on macroeconomics, he wanted to point out the extreme degree of difficulty involved in making something like debt forgiveness work out well.

He cited a co-authored article from the New York Times describing some examples of where good intentions had gone awry.

We see this now with student loan debt. First, the existence of student loans allows the price of the education they purchase to continue to rise.

And then, when the accumulation of debt creates an overhang of indebtedness that cannot be serviced by the jobs for which the education equipped its graduates (there are not so many jobs for puppetry graduates), the government decides that social justice requires the debt to be forgiven.

Those who paid outright for their education or did pay off their student loans early wonder if they were foolish. They should have taken out a loan, defaulted, and waited for forgiveness.

Why Will This Time Be Different?

I agree with Ronald Reagan’s famous quote: the nine most terrifying words in the English language are “I’m from the government, and I’m here to help.”

This reminds me of the wonderful C.S. Lewis quote:

“Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies. The robber baron's cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience.”

How should all the debt be dealt with?

There are conventionally two ways:

Increase productivity to produce more economic activity, more profits for businesses and individuals, and more tax revenues for the government to service debt;

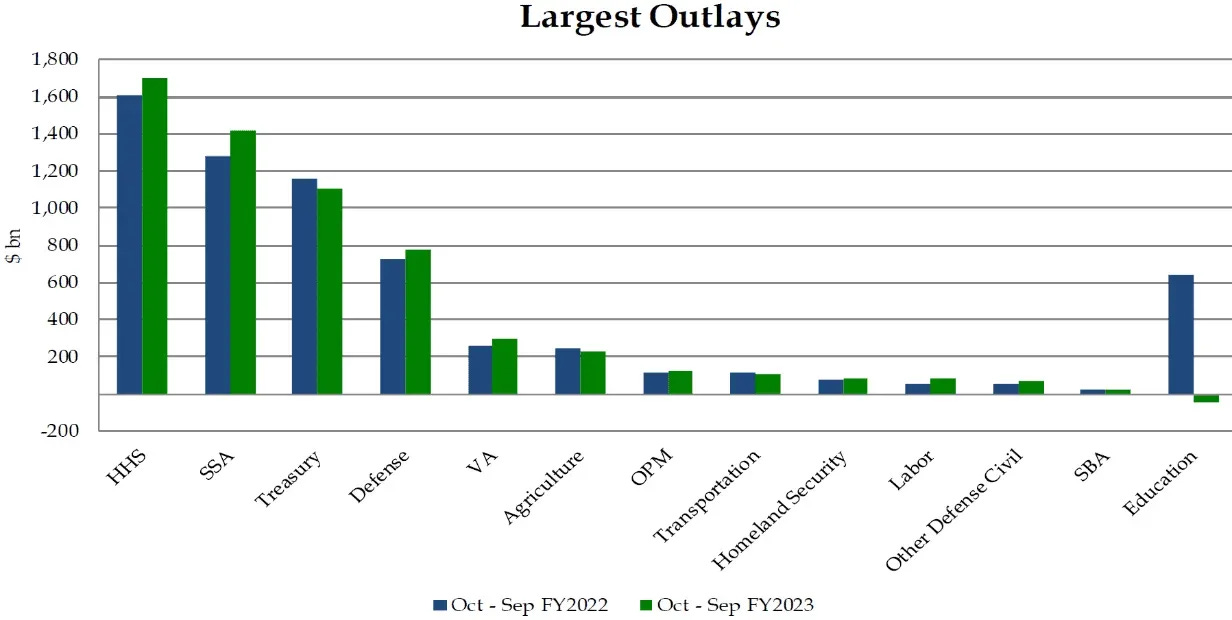

Reduce expenses, which, for the government, means defense or entitlements

I think there may be a third way. Let’s think of it as methadone.

We have become addicted to the Fed, and we have to go through some rehab.

Going cold turkey will be too painful—for the US and for the rest of the world.

The World Bank would typically prescribe fiscal austerity, which has been applied in the past for several economies, including Argentina, Chile, and Colombia.

It’s what Milei is putting Argentina through at the moment.

He was democratically elected on a platform and promised to do exactly what he is doing, yet there are massive public protests.

This is not the path the US is going to take. The US has the privilege of being the world’s reserve currency, and it needs to use that privilege.

The Third Way

What would ordinarily happen with the Treasuries held by the Fed is that, on maturity, the Treasury would issue more debt, collect the cash from the private economy, and use it to redeem the securities held by the Fed.

Or, it would redirect tax receipts to redeem the debt. In either case, cash would move out of the private market - businesses or individuals - and that would be deflationary.

It would be the opposite of fiscal stimulus.

The third way is what is most likely to happen.

We will kick the can down the road.

The government is now 23% of GDP. This part of GDP is not going away and provides a substantial underpinning of continuing economic growth.

The Fed needs its twin bubbles—the stock market and housing—to continue. That is the only way it will generate the tax receipts it needs to keep all the plates spinning.

Leaving the cash in the economy would help, especially if there is no bid to refinance those Treasuries when they fall due.

But…the problem is that leaving cash in the economy risks it not going where we would ideally want it to.

Even if the Feb were to forgive the debt it owns, that is only part of the solution. It makes a dent, but it does not get the job done.

It would be Steps 1 and maybe 2 of a 12-step process. It would be a third way, but maybe not the third way.

It’s All About The Banks

Suppose the premise is that we are addicted to the Fed’s role in the economy, and we accept that we are in the process of rehab to cure that addiction. In that case, the only way to make that happen is to suck the cash back out of the economy and redirect it to productive uses.

The banks can easily be incentivized to refinance the securities held by the Fed.

All that needs to happen is for the Fed to ease the reserve requirement on the banks holding Treasury debt.

Once the Treasury has the cash back in its own bank account (TGA), the only productive use that is not guaranteed to continue the addiction is energy.

Energy is the base layer of all economic activity.

The Inflation Reduction Act expresses the government’s desire to use industrial policy to induce domestic activity that keeps jobs and manufacturing onshore.

Unfortunately, its strong bias towards renewable energy needs some adjustment to be truly productive.

We need to change how we measure the cost of renewable energy and acknowledge the destabilizing effect of intermittent energy sources on the grid.

Those topics are beyond the scope of this article.

It would, for example, be way more productive if the government reallocated a substantial portion of the $389 billion it has scored for the cost of the Inflation Reduction Act into nuclear.

Takeaways

We are addicted to the Fed being a central part of the economy

The size of the US debt burden is large enough to designate as an emergency similar to WWII, the GFC, or Covid

The banks should repurchase the amount of the Treasury debt held by the Fed as it falls due

The cash removed from the economy on redemption should be invested in boosting energy production

The energy investment should be made based on a proper accounting for the cost of renewables on grid stability and on the ancillary energy sources needed to backup renewables

Can we rely on politicians to do the right thing?

Look at this conversation on X between Luke Gromen, Brad Setser and Andy Constan. FX reserves conversation has evolved after US sequestered Russian FX reserves post Ukraine invasion.https://x.com/NeilWinward/status/1815451481748783143