How Geopolitics Is Reshaping Your Investment Strategy – What You Need to Know Today

…to take care of your portfolio…

Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 7 minutes. Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives, so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

Macro Snapshot/Current News

Geopolitics are the ultimate macro overlay: they rewrite the script, change the actors, and revise the budget.

What If Global Tensions Escalate?

Great companies adapt and thrive but are not immune from shocks. What would happen if:

An attack by Israel and the US on Iran’s nuclear infrastructure were to close the Straits of Hormuz?

What would happen if China downed a Qantas flight accidentally during live-fire drills in the Tasman Sea?

What would happen if one significant European power invaded another and had $300 billion of its USD reserves sequestered?

In 2024, 23% of cargo through the Straits was rerouted due to increased tensions with Iran and fears about ship seizures.

Last week, China issued emergency broadcast warnings, causing about 49 flights to be re-routed. The maneuvers in the Tasman Sea were in international waters and perfectly legal, but…

Russian and Ukraine - How This Impacts Gold & Treasuries

Russia did invade Ukraine, and $300 billion in USD reserves were sequestered. Let’s take a look at what this has done to markets.

Gold

Since the invasion of Ukraine, the price of gold has increased by nearly 50%, and the S&P 500 has risen by 31%. Over the last three months, the S&P 500 has remained flat to slightly down, while gold has increased 11%.

The trigger for this has been the shift in central bank buying, which has increased five-fold since 2022. As non-U.S. central banks reflected on the U.S. imposition of sanctions on Russia and the sequestering of $300 billion of Russian USD reserves, they concluded it would be wise to diversify their reserve holdings away from U.S. Treasuries and towards gold.

As the U.S. reflects on its debt issuance (see below), it has concluded that it may need to resort to novel issuance techniques involving long-term, gold-backed Treasuries issued to allies (assuming it does not alienate them all).

Chatter about gold as a store of value has increased markedly during these times of geopolitical tension when inflation has reappeared for the first time in decades.

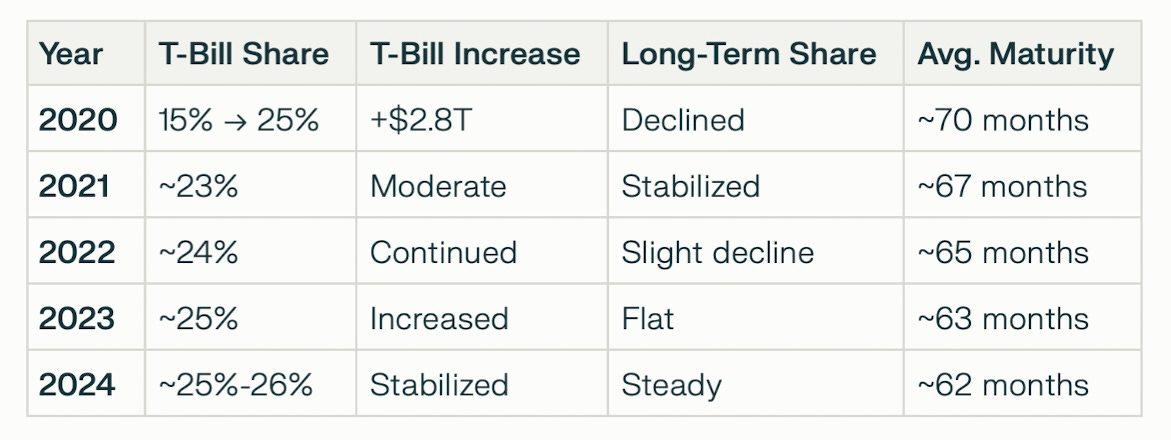

Treasury issuance (how the government funds its $36 trillion of debt)

The chart above shows the shift in issuance of Treasuries from the historical mix, mainly because the then-Treasury Secretary, Janet Yellen, was not confident of the Treasury’s ability to issue at the long end.

In other words, she feared a failed auction or that raising debt at the long end would be unacceptably expensive. Since most mortgage debt prices off the 10-year Treasury, this would have been a big problem for the housing market.

By issuing more at the short end, Yellen created more scarcity at the long end, thus suppressing the 10-year yield below what it otherwise might have been. This is also known as “soft” yield curve control (YCC).

Scott Bessent, Jane Yellen’s successor, said in mid-2024 that he would prefer to revert to a more normal issuance pattern.

On the first occasion he had the chance to do so—the Quarterly Funding Review on February 5th, 2025—clearly, he had been ‘read into’ the market dislocation problem. He opted to continue the predominance of short-term issuance, which was more soft YCC.

As the chart above shows, since Yellen began her soft YCC in 2020, gold has increased 126%, the S&P 105%, and the USD nearly 10%. Bitcoin has gone from $20,000 to over $84,000 (peaking at $108,000). Market commentators (including Luke Gromen) have noted that Bessent’s soft YCC is likely to produce more of the same.

Bessent and Trump have both said their focus is less on the Federal Reserve's moves to reduce the discount rate and more on taking steps that would have the market trade down the 10-year yield.

These two geopolitical factors - gold and Treasury issuance - have both had substantial effects on investment portfolios:

Gold has become a more significant part of asset allocations;

At 4%+, with inflation at 3%, short-term (<2 years) Treasury bills have become more attractive to hold and a reasonable way to get a decent amount of low-risk income while evaluating shifts in market opportunities.

The House Passed a Budget Resolution

This, as Joe Biden once said about Obamacare, is a big f#@cking deal.

It is the first step towards producing the tax legislation needed to enact the new administration's policies.

It aims to extend the personal tax rates enacted in the Tax Cuts and Jobs Act 2017 for a cost of $4.5 trillion. It seeks to pay for these by reducing expenses by $2 trillion over the next ten years and from the economic growth and resulting tax revenues that will (undoubtedly) result from the tax cuts.

The budget must now go to the Senate. If they agree to proceed with it, the outline numbers can be translated into legislative language. This will comprise a tax bill that can be passed through reconciliation. This process requires a simple majority and, therefore, no Democratic support.

The budget itself comprises 201 pages of numbers. Notwithstanding the many press conferences and messages from many in Congress, specific measures to fulfill the promises of the numbers have not yet been agreed.

Details will leak in the next few weeks, but the outcome of the meat grinder is not yet known. For now, statements about details are more about politics than facts.

Through The Looking Glass

While votes at the U.N., where Russia, the U.S., and North Korea voted together, and statements about Zelensky being a dictator who is responsible for the war may seem strange, it is wise to look at what is happening on the ground.

The deal struck on Ukraine’s mineral wealth (see Must Read Pieces on Today’s Market below) is one tangible outcome of the rhetoric. There is no more reason to think that Trump will stick to his word with Russia than there is reason to rely on his loyalty to any person or country. He is, as he always is, purely transactional.

It is not far-fetched that his requirement to have Europe be the primary author of its own defense could be satisfied by having European allies buy substantial amounts of Treasury bonds at a very low interest rate, possibly backed by gold. This would, of course, be bullish for the gold price.

In The Markets

- The S&P 500 traded lower this week and may be a bit oversold at 5,881

- BTC was crushed this week. It started the week at $96,000 and is now trading down over 15% at $81,000.

- The 10-year Treasury started the week yielding over 4.5% and strengthened to 4.25% on fears that the economy is slowing.

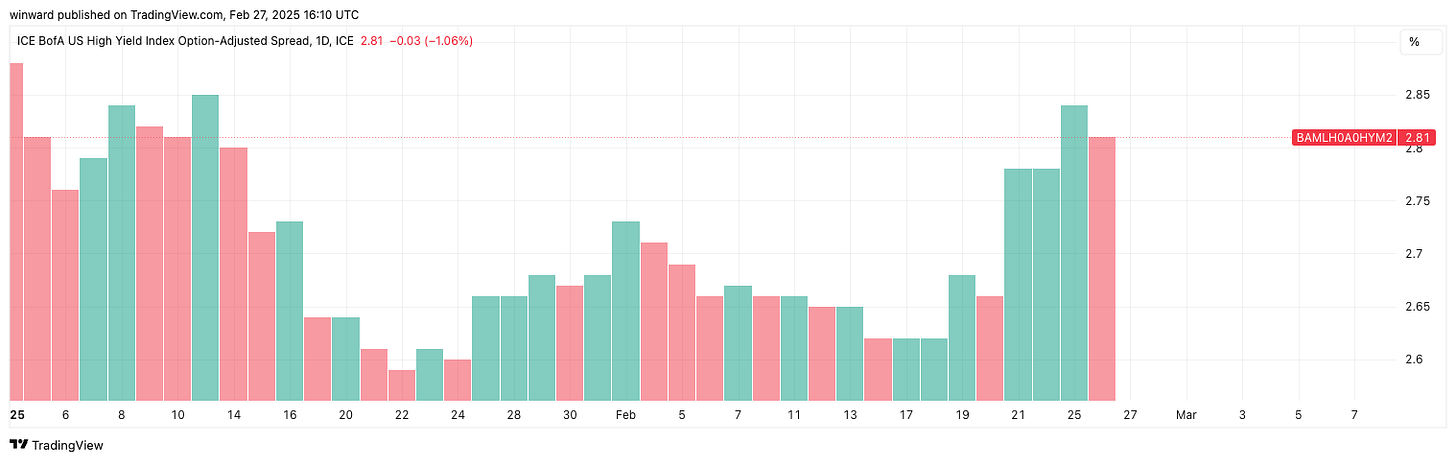

- Credit spreads are widening a bit from their YTD lows - worth watching.

In summary, stock markets are not yet caught up with geopolitics. Precious metals are getting there.

Must-Read Pieces on Today’s Market

This rather lengthy post from Noah Smith is worth a read. Smith’s perspective is from the left, but he tries - and succeeds - to call balls and strikes. This piece outlines why, despite how one feels about Elon Musk, one should not equate doing hateful (depending on one’s perspective) things with being low-IQ.

By the way, I don’t think I'll read the longer post he claims to be working on—this one is quite enough!

This interview on

with Michael Every is worth a watch. Trigger warning: there is a discussion of why it probably makes sense for Canada to become the 51st state…Click on the image below to get the full text of the US-Ukraine deal on minerals.

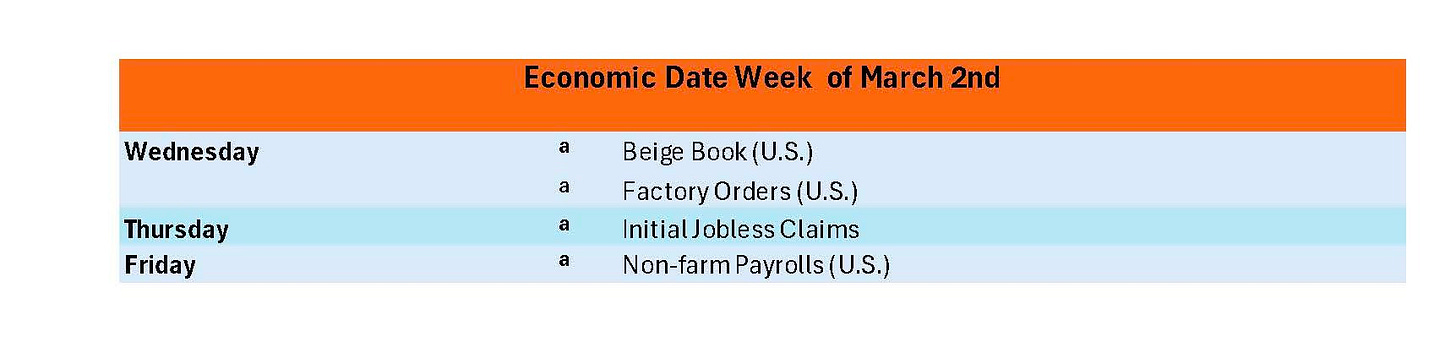

On The Horizon

A short one this week focused on just a few U.S. events. I think the main item of interest (hmm) is the Beige Book.

The Beige Book is published eight times per year, two weeks before Federal Open Markets Committee (FOMC) meetings. It provides qualitative insights into current economic conditions across the 12 Federal Reserve Districts. It gathers data from interview, surveys, and reports from businesses, economists and community organizations. Worst case, better than a sleeping pill.

One thing worth noting is Canada’s election forecasts. Trump seems to have caused a massive swing for the Liberals (currently, Mark Carney is leading in the polls to take over the reins of the Liberal party from Justin Trudeau). Six weeks ago, the Conservatives were leading by 26 points. Now, that lead is a mere two points. Politics are volatile!

Quote of The Week

When discussing plans for a sovereign wealth fund, [Treasury Secretary, Scott] Bessent said revaluing U.S. gold reserves is “not what I had in mind.” (Gold sold off a bit).

As British journalist, Claud Cockburn (pseudonym, Frank Pitcairn) was fond of saying: “Believe nothing until it has been officially denied.”

Town Hall

What are your thoughts on the effects the geopolitical landscape will have on financial markets. Reply in the comments below - we read every reply.

Five Ways To Support MacroMashup

If you are interested in clean energy investment advisory services, book a complimentary call here

Please subscribe to our new YouTube channel - or support our audio podcast by following us on Spotify or Apple - we appreciate your support!

If you'd like me to be a guest on your podcast or guest blog about clean energy or macroeconomics, send an email to contact@macromashup.com

Share this newsletter on X here

If you enjoy this newsletter, please email it to a friend by clicking on the button below.