Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 10 minutes. Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

Some of you know what I do for my day job: I work with developers and investors in renewable energy projects to help them monetize the tax benefits the Inflation Reduction Act (IRA) offers.

This week, we are going to take at look at the following:

Where are the IRA benefits happening?

Why is that? Political calculus or something else?

Why do people love their tax benefits?

Is this an ill-conceived policy?

Where Are The IRA Benefits Happening?

When I speak to people about this, the first question is “Hey, won’t Trump repeal this legislation if he is elected?”

I get it. In the iconic movie, Napoleon Dynamite, one of the principal characters, Pedro, was running for high school office: “Vote for me and I will make your wildest dreams come true.”

It feels as if that’s where our Presidential candidates are right now. Trump will say anything to please his base and seek out the undecideds. Killing everything renewable - EVs, Solar Panels, Wind Turbines - is red meat to Trump’s base…at least he thinks so.

And Harris will embrace things she once claimed to revile - fracking - if…she feels the position is popular to a target voting group.

I don’t mind if politicians change their minds. They just need a good reason…and the position needs to be credible. I’m not sure anyone believes they are getting their wildest dreams.

But…one of the richest ironies about the IRA is that the majority of benefits have so far fallen to Red states.

Bloomberg recently did an excellent feature on this.

The article contains some great stories. This is one:

The single largest investment in the burgeoning US green energy supply chain involves a construction site the size of 121 football fields near Greensboro, North Carolina, and a check for $13.9 billion. By 2030, the Toyota Corp. facility could be employing more than 5,000 people cranking out enough batteries to power half-a-million new electric vehicles each year.

What’s not to like about that? This seemingly rhetorical question actually demands an answer given America’s partisan divide over climate change.

The Toyota project, which began with a $1.3 billion initial investment announced in 2021, massively expanded after passage the following year of the Inflation Reduction Act (IRA), President Joe Biden’s signature green legislation offering hundreds of billions of dollars in subsidies for clean technology. The IRA was unanimously opposed by Republicans in Congress. Its cousin, the Infrastructure Investment and Jobs Act, containing a smaller set of cleantech subsidies, was nominally bipartisan but only drew 13 “yeas” from House Republicans when it passed in 2021.

One Republican critic of the IRA said, using fairly typical language, that it would “raise taxes” and “throw money at woke climate and social programs that won’t work.” That critic, Rep. Richard Hudson, represents North Carolina’s 9th district, which happens to be where Toyota is building that mammoth battery plant.The article points out that:

“There is a certain luxury enjoyed by politicians who can be rhetorically against something while still quietly welcoming any dollars and jobs that it brings to their constituents.”This is a tradition where a politician votes against something they know will pass to preserve the integrity of their opposition for political purposes while privately conceding the legislation might be a good thing.

Other fun facts include

The breakdown of the $206 billion in Cleantech investments allocated during the Biden Administration is:

$42 billion in Democratic House Districts ($18 billion allocated pre-IRA; $24 billion post-IRA)

$161 billion in Republican districts ($57 billion allocated pre-IRA; $105 billion post-IRA)

Of the 51 projects in the country that top $1 billion, 43 are in red districts

Of the top 25 districts in the country for announced Cleantech manufacturing investment, 21 have a Republican representative in the house - those districts account for $119 billion in investment and over 80,000 jobs.

Why Has This Happened?

Has this been a smart political move to make sure that the Republican voting base is incentivized to support the legislation, ‘bribed’ with money and jobs?

Not a bad idea. Certainly, Trump was ineffective in repealing the Affordable Care Act because, by the time he tried, people had grown to love healthcare access. John McCain helped, but benefits are powerful and people don’t like giving them up once they have them.

There are solid reasons why the projects are more easily sited in the Redzone: red districts generally have looser permitting, cheaper, more plentiful land, more favorable labor laws. They are sunnier, windier. It makes sense.

Here are some more examples from the Bloomberg article:

Cleantech Jobs Provide a Big Boost for Local Economies

Top five projects, ranked by expected employmentELLABELL, GA

Hyundai batteries, EVs

8,100 jobs

Equivalent to 39% of county labor forceRUTLEDGE, GA

Rivian EVs (project paused)

7,500 jobs

77% equivalentSTANTON, TN

Ford EVs

6,000 jobs

74% equivalentLIBERTY, NC

Toyota batteries

5,100 jobs

8% equivalentGLENDALE, KY

Ford, SK On batteries

5,000 jobs

10% equivalent

Source: US Department of EnergyPhotos via Getty Images: Elijah Nouvelage/Bloomberg (Hyundai); Bing Guan/Bloomberg (Rivian); Houston Cofield/Bloomberg (Ford); Logan Cyrus/AFP (Toyota); Jon Cherry/Bloomberg (Ford/SK)It’s an impressive list and any politician voting against this tide is going to struggle.

Why Do People Love Their Tax Benefits?

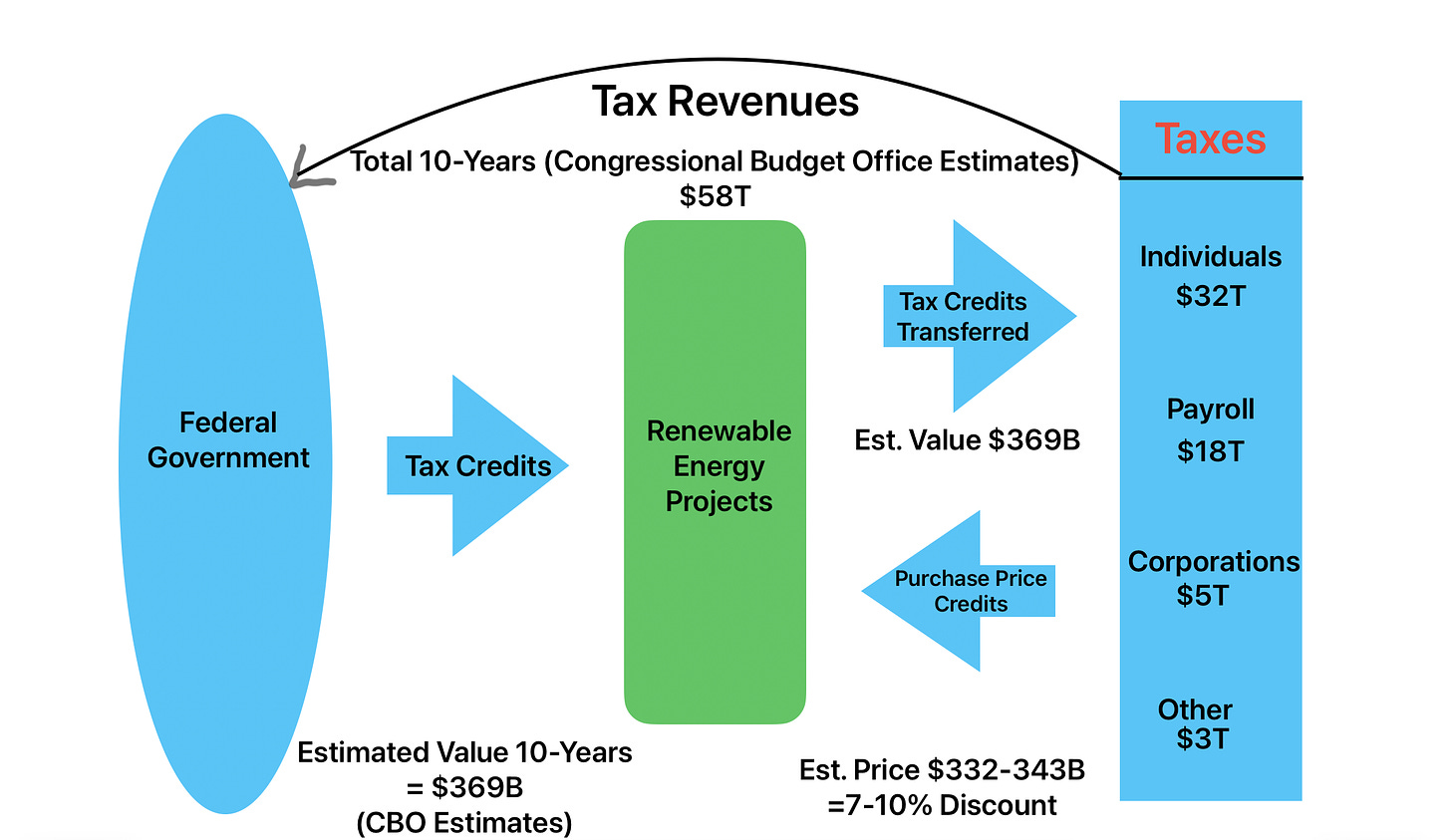

The IRA scored the tax benefits offered by the legislation at $369 billion over ten years. But the benefits are not capped. If developers bring $1.5 trillion in benefits to the table, the only constraint is the ability of the Federal government to divert that much tax revenue.

I think that constraint might be real in the context of $2 trillion budget deficits. But, hey…

People have a love-hate relationship with taxes. They want the things taxes buy, such as roads, bridges, defense, and social programs, but they love saving taxes.

Here’s what the IRA looks like:

I love this chart for a few reasons:

I made it on my iPad.

It shows the picture of incentives over ten years.

It shows where the tax revenues come from.

It shows where they go: 90% to the developers of renewable energy projects; 10% to the investors who facilitate the whole thing.

It’s a neat illustration of how the government quarterbacks industrial policy with tax revenues.

It’s beautifully ironic: the people who hate taxation ought to love this because it’s returning tax dollars to the taxpayers.

Now we are going to get a little wonky.

What people care about is how taxation is distributed. That wonderful chart above shows that individuals pay over 6x the amount of tax that corporations pay.

And yet, for reasons I will explain shortly, it is way easier for corporations to get the IRA tax benefits than it is for individuals.

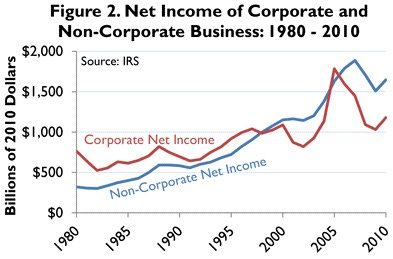

What makes this interesting is that the distribution of corporate taxes paid has shifted:

Over 50% of corporate taxes are now paid by pass-through companies—LLCs, partnerships, or S-Corporations—where corporate income shows up on individual tax returns.

So, business and individual taxation is becoming more and more intertwined.

Because tax breaks such as the energy credits promoted by the IRA have historically been focused on corporations, the question arises of whether individuals can also use them.

The answer is “yes”, but…

It’s All About Passive Income (this is the wonky bit)

Individuals can use all the IRA credits provided they have passive income.

When we think of passive income, we first think of income that is NOT wages or business income.

We think of income from our investment portfolios, but the IRS considers passive income differently.

The IRS thinks of passive income as income derived from:

1. Trade of business activities in which an individual does not materially participate;

2. Interests in partnerships, S-corporations, and limited liability companies that conduct such activities in which a taxpayer does not participate;

3. Equipment leasing;

4. Rental real estate.

Income from stock investments, dividends, interest, and capital gains is not considered passive income.

The IRS defines this as "portfolio" income that cannot be offset by purchased tax credits.

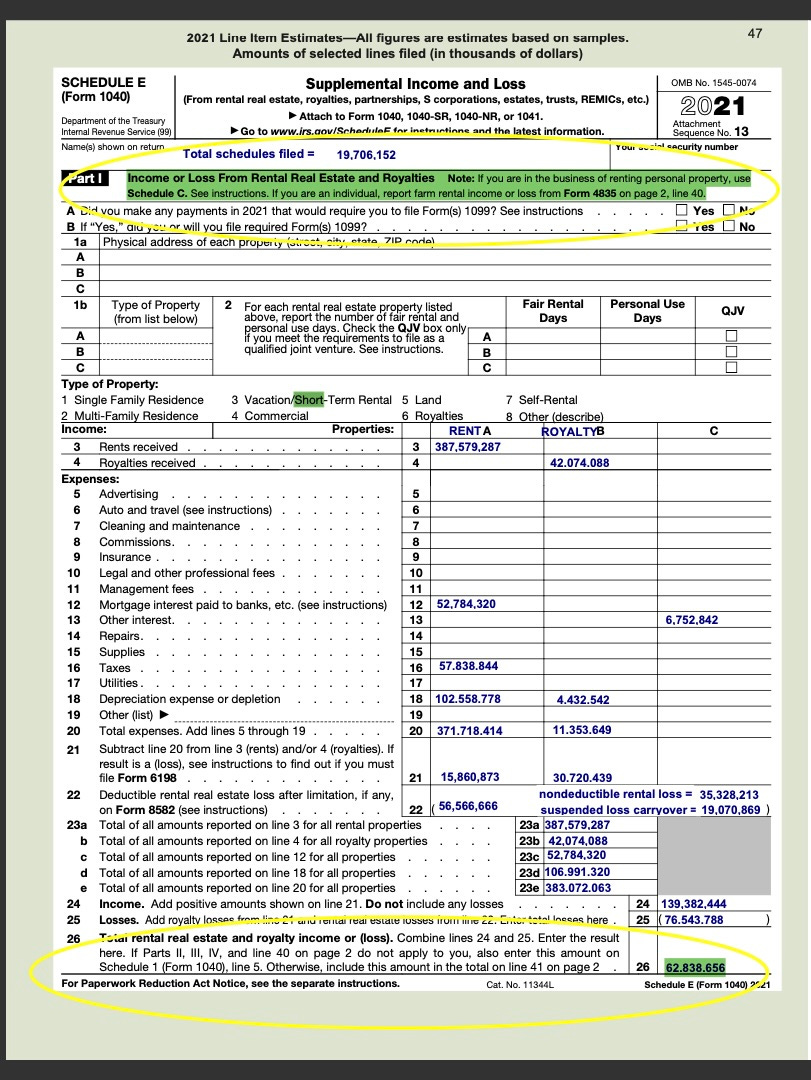

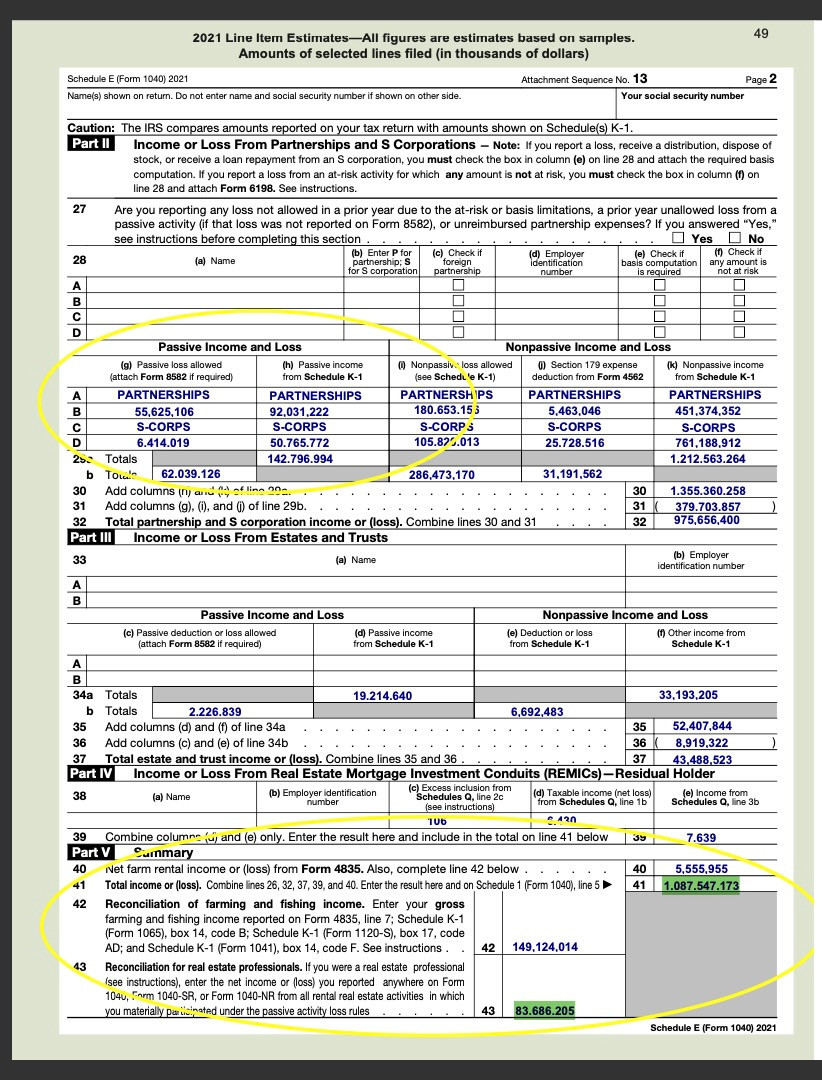

According to IRS data - the latest available is from individual 2021 tax returns, there were:

$62B in passive income from rental and real estate.

$143B in passive income through partnerships

An average tax rate of 26% for the top 1% of taxpayers suggests $53B in tax that renewable energy tax credits could offset.

Here is the summary data (I love the fact that the IRS produces this data):

My day job is fixing this manifest injustice…

Is This Ill-Conceived Policy?

In some senses, the IRA is bad policy. It is a stretch to describe it as anti-inflationary.

There are good arguments for why intermittent energy is destabilizing the grid, gobbling up productive land, throwing up structures that are going to litter the landscape in thirty years, and requiring a massive overbuild of energy sources to back them up when they are not available.

I have made some of these arguments and will continue to do so. On the other hand, in the same way you can’t fight the Federal Reserve, you can’t fight these incentives. The projects are going to be built.

It is also fair to say the IRA is an “all of the above” piece of legislation. The recommissioning of the Three Mile Island nuclear plant closed in 2019 for economic reasons, will generate $2.5-3 billion of IRA benefits.

It will generate 3,400 jobs, 600 of which will be permanent, together with $3.6 billion in state and Federal tax revenues.

There are credits for fugitive methane mitigation (trapping the leaks from old coal mines, for example), carbon capture, and sequestration (taking the emissions from natural gas generators and burying them, or using them to extract more oil).

How these credits will be allocated is largely up to the private sector, as it should be.

On balance, the IRA is great policy.

Takeaways

The fact that the IRA benefits have fallen disproportionately in Red states insulates it from Trump, should he (shudder) be elected again.

The fact that the benefits have fallen this way is a great example of the government nudging the private sector and then letting the chips fall where they may.

Making sure the tax benefits are allocated not just to corporations is a worthy undertaking (yeah me!)

Creating incentives for the private sector to compete for benefits across a range of technologies - wind, solar, nuclear - is smart, and good policy

Excellent piece Neil. Really enjoyed it. But I disagree with the notion that IRA spending in red counties or states will protect it from Trump. Look at Medicaid expansion, this results in increased federal dollars for healthcare yet 9 Red states never adopted it. Basically ideology will trump self-interest. And speaking of Trump, if he proposed a massive IRA Roll-Back, a Republican controlled Congress will surely go along even if it's detrimental to their constituents. Lastly, parts of the IRA, like the GGRF, are very dependent on federal agency implementation and that would almost certainly end even if the dollars have been appropriated.