How a $55 Million Investment Wiped Out $1.2 Trillion of US Stock Market Value

Don't put this on your iPhone.

Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 7 minutes. Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives, so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

Macro Snapshot/Current News

DeepSeek

The market freaked out this week about the Chinese large language model (LLM), DeepSeek.

DeepSeek built an LLM with the same capabilities as ChatGPT’s latest model for free rather than $20/month.

It allegedly spent $55MM on building it and used far fewer Nvidia chips than the US-based LLM providers.

Because ChatGPT is a private company without publicly traded stock, the market reacted by chopping over $700 billion off Nvidia’s market cap (over 60% of the overall $1.2 trillion decline in the S&P 500).

NVDA provides the chips to the so-called hyperscalers—Google, Amazon, Microsoft, and Meta—whose capital expenditures directly affect Nvidia’s revenue.

DeepSeek could be a Sputnik moment for big tech. Just as the Soviet Union's 1957 launch of the Sputnik spacecraft into orbit sparked a wave of US innovation, DeepSeek could be a wake-up call to hyperscalers to be less complacent about their AI advantage.

The DeepSeek news was just the catalyst for a market stretched thin on high valuations to take a pause.

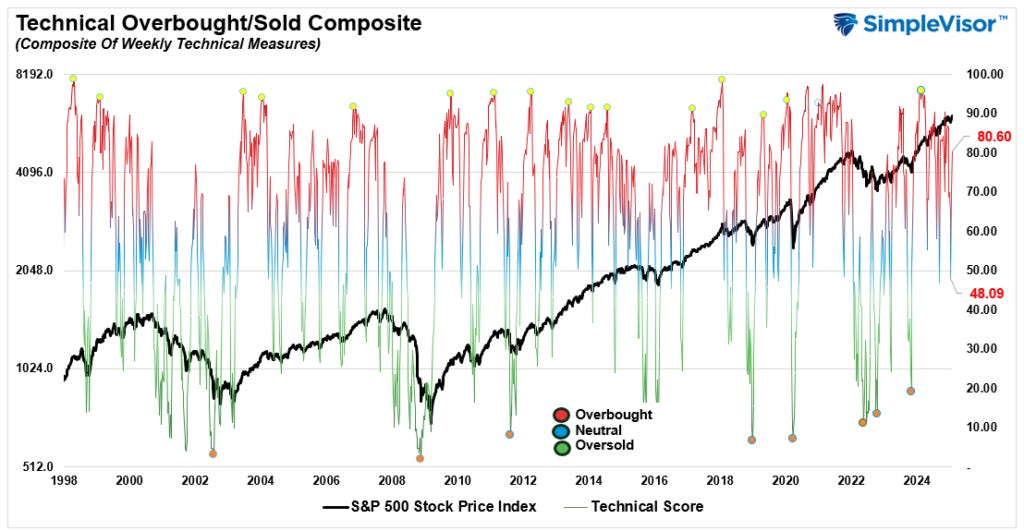

The market was and remains overbought:

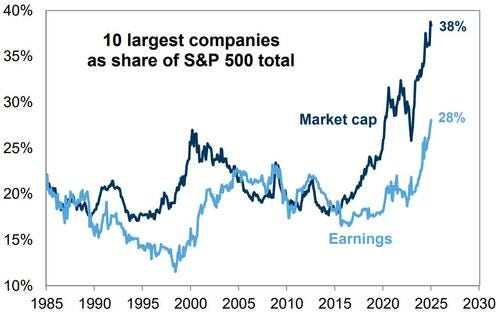

With the S&P 500 dominated by a few very large companies, the impact of any one of these on the overall index is exaggerated.

As I said last week now is the time to rebalance while the index is still strong.

Geopolitics and Domestic Reset

We will all have to get used to some volatility in the news cycle.

I am not going to do this every week because it will become tedious, but I prefer looking at everything all at once to keep track of the cadence of change rather than the drip of everyday outrage (skim through it if even this is too painful):

Executive Orders and Policy Changes - Trump’s Scorecard

Declared an “invasion” at the southern border, enabling military involvement in immigration enforcement, including deportations and detentions.

Suspended the U.S. Refugee Admission Program and stopped refugee arrivals pending a 90-day review.

Issued an order redefining birthright citizenship, asserting that children born in the U.S. to non-citizen or temporary resident parents are not citizens. This order is already facing legal challenges.

Directed the Justice Department to challenge sanctuary city policies and threatened legal action against officials opposing immigration enforcement.

Ordered federal employees to return to in-person work - or take a buyout of 8 months’ pay - ending remote work policies.

Eliminated diversity, equity, and inclusion (DEI) programs across federal agencies and contractors, placing DEI staff on paid leave with plans for layoffs.

Ended affirmative action mandates in federal hiring and contracting.

Reinstated troops discharged for refusing COVID-19 vaccines and rolled back diversity programs in the military.

Announced plans for a space-based missile defense shield.

Declared a National Energy Emergency to boost domestic energy production, rescinded Biden-era energy regulations, and paused federal leasing for wind farms.

Reopened offshore drilling opportunities and expanded resource development in Alaska.

Fired at least 17 federal inspectors general across agencies, sparking criticism of a “chilling purge”.

Removed Gwynne Wilcox, the first Black woman to serve as acting chair of the National Labor Relations Board, despite legal protections for board members.

Pardoned nearly all individuals charged with the January 6 Capitol riot.

Withdrew the United States from the Paris Climate Agreement and reversed regulations on electric vehicles and other environmental policies.

Paused federal grants and loans for an ideological review of funding priorities, potentially affecting healthcare research and education programs…and then paused the pause.

President Trump is trying to do a hard reset of geopolitics.

He was told on the 3rd hole of his Sunday golf round at Doral that Colombia would not let US planes bearing deportees land.

He ordered up 25% tariffs. By the 8th hole, Columbia had caved and sent their own planes.

This reminds me of President Reagan firing 11,345 air traffic controllers in August 1981. It was a significant reset with disproportionate consequences. Let’s see how it goes for Trump.

In The Markets

The Fed held another meeting this week and continues to gaslight the market about inflation. While inflation is clearly nearer 3% than 2%, the Fed asserts it is moving in the right direction.

Meanwhile, it has paused on the rate-cutting cycle. Why would it do that if it felt inflation was heading in the right direction?

The market seems sanguine about this. Perhaps it has figured out that the Fed knows inflation will reset closer to 3%, but it can’t admit it.

Meanwhile, the market has adjusted to the reality of higher for longer.

- Stocks traded back to above 6,000 on the S&P 500

-The 10-Year Treasury continues to trade above 4.5%

-BTC continues to be volatile. I sold my position and, rather than keep the target buy order at $95k, I will wait to see how it performs.

This chart is not comforting:

Double tops are not a great sign. The methodology is complicated, but the implication is that if BTC breaks the $91,000 level, it will go significantly lower.

Gold has a similar double top, but the overall support levels are higher. Although central banks are not yet buying BTC on a large scale, they are continuing to buy gold.

Great Shares

When I think about the vast wind farms I drive past on I-80 across America’s breadbasket, the effort that went into each one is daunting —this video is eye-opening!

On the subject of wind, this is from

. It speaks to the bleak fate of offshore wind for the next four years.Thanks to some very generous friends, we spent a few days at the Sundance Film Festival this week.

Sundance (possibly all film festivals) is remarkable because the introduction by the director/writer and the Q&A afterward with the director/writer and actors means you have at least some appreciation for the effort that went into making the movie.

We saw the 12 listed below (with links to IMDB)

Atropia - brilliant and quirky/concerning.

Bubble & Squeak - poorly reviewed but I liked it. It had a simple point to make, and made it well.

Love Brooklyn - wonderful Brooklyn vibe: the movie equivalent of Nora Jones song.

Marlee Matlin: Not Alone Anymore - insights into the world of a deaf actor.

By Design - hmmn.

The Ballad of Wallis Island - very feelgood.

If I Had Legs, I’d Kick You - intense portrayal of caregiver trauma by the excellent Rose Byrne.

Jimpa - movie royalty with John Lithgow and Olivia Coleman.

The Thing With Feathers - acting class by Benedict Cumberbatch

Train Dreams - beautifully shot but not gripping.

The Wedding Banquet - meh.

Together - my first body-horror movie. Brilliant and funny.

On The Horizon

Next week is a big week for employment and economic data:

Monday:

ISM Manufacturing Index (Monday - 10:00 AM ET)

U.S. Auto Sales

Tuesday:

Trade Balance (8:30 AM ET)

ISM Non-Manufacturing Index (10:00 AM ET)

JOLTS Job Openings (10:00 AM ET)

Wednesday:

ADP National Employment Report (8:15 AM ET)

Thursday:

Weekly Jobless Claims (8:30 AM ET)

Wholesale Trade Data (10:00 AM ET)

Friday:

Employment Situation Report (8:30 AM ET)

Preliminary Michigan Consumer Sentiment Index (10:00 AM ET)

I’m not convinced that any of these changes the direction of travel, but they are what traders think about when they show up to their screens at 7:00 AM.

It’s worth a look to see how the market conversation shifts.

But remember, very few things make the kind of impact DeepSeek made this week.

Quote of The Week

From RFK Jr.’ confirmation hearing:

“Our ship is sinking. Our 60% increase in Medicaid over the past four years is the biggest budget line now, and it’s growing faster than any other. No other nation in the world has what we have here.

No other nation has a chronic disease burden like we do. We have the highest chronic disease burden of any country in the world. During COVID, we had 16% of the COVID deaths in a country where we only have 4.2% of the world’s population. We had a higher death count than any country in the world.

And when the CDC was asked why, they said it’s because Americans are the sickest people on earth. The average American who died from COVID-19 had 3.8 chronic diseases. This is an existential threat—economically, to our military, to our health, and to our sense of well-being.”

Four Ways To Support MacroMashup

If you are interested in clean energy investment advisory services, book a complimentary call here

If you wish to see even more content from MacroMashup, check out our podcast (coming in February).

If you'd like me to be a guest on your podcast or guest blog about clean energy or macroeconomics, send an email to contact@macromashup.com

If you enjoy this newsletter, do me a favor and share it with a friend by sending them this link www.macromashup.com

The market sure is overbought. And I don't think inflation is coming down. Rates will have to go up. DeepSeek is just a catalyst. Like you pointed out, there is a lot that can go wrong.

But, I was intrigued by your subtitle "Don't Put This On Your Phone". Is DeepSeek spyware as well as a ChatBot? It would not surprise me.