How To Avoid The Mistake Everyone Makes With Their Financial Advisor...

...this isn't a quick fix, though

Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 7 minutes (this week is a bit longer because of the Deep Dive). Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives, so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

Macro Snapshot/Current News

I will deliver on one of the Deep Dives I promised last week - mistakes you make with your financial advisor.

This Snapshot section will be shorter to ensure you are not overwhelmed!

We have a new President! Some of you hate that. Some of you love that.

I was getting so sick of the old administration. I am ready to be sick of the new one.

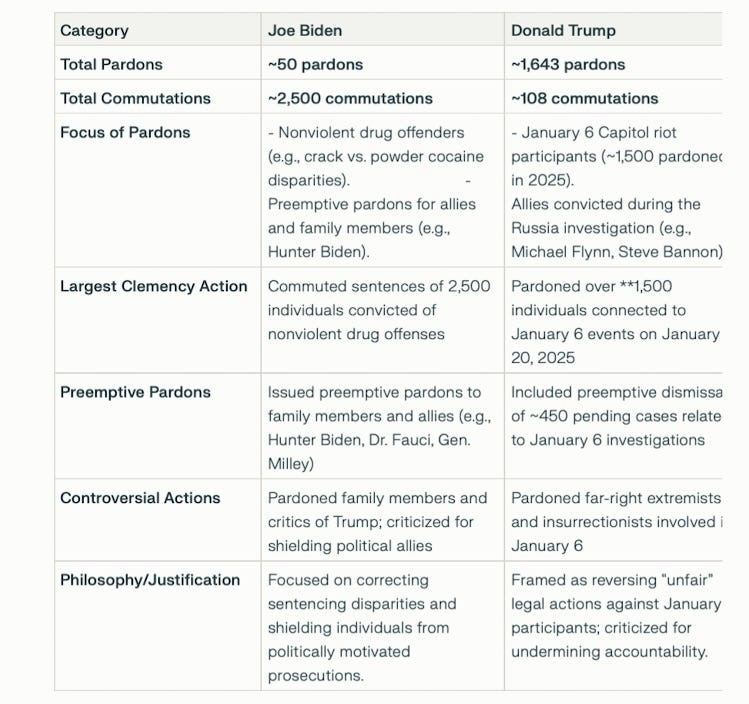

Picking one thing only - the Pardon Race - here’s the tally:

The right is horrified at Biden pardoning family members.

The left is horrified at Trump pardoning January 6 convicts.

Each side thinks the actions of their side are justified and the actions of the other unforgivable.

Maybe it is time to take the power of the Presidential pardon away. Reductio ad absurdum.

In The Markets

- Credit spreads remain tight at 2.59% (high-yield bonds compared to T-Bills).

-The S&P 500 continued to push all-time highs above 6,000, driven by:

Enthusiasm about the inauguration and its assumed business-friendly posture

A rebound from oversold conditions in December and early January

If you need to rebalance but have been reluctant to sell positions that were in the red for the last month, now may be a good time to do so.

-The 10-year bond was essentially unchanged at around 4.62%, but concerns about inflation are continuing. Don’t expect much more Fed cutting this year.

-Bitcoin remains volatile, moving between $90,000 and $106,000. I placed a target buy order at $95,000. Let’s see how quickly it gets filled.

-Gold continues to move higher, close to $2,800.

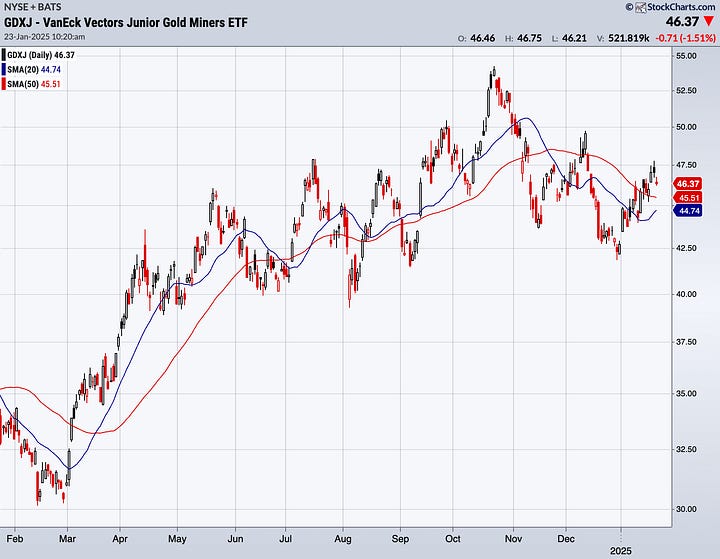

-I am now beginning to look at gold miners. There are two ETFs to look at here:

GDX for the larger companies

GDXJ for the smaller ones.

Both have performed well over the last year. Both are moving up so far this year.

They are a levered play on the gold price. As demand rises and gold prices increase, gold miners tend to perform better as revenue increases relative to their fixed operating costs.

If you want to invest in gold, legendary commodities investor Rick Rule is the best resource. I have included a recent link below under Great Shares.

Deep Dive

How To Avoid The Mistake Everyone Makes With Their Financial Advisor...

I promised a deeper dive into this, so here goes.

In an earlier newsletter, I claimed to have figured it all out after 63 years —not quite!

The dark secret of writing anything is that you don’t tell your readers everything.

How I Look at the World

I have two official businesses, and I am growing a third.

The first is an advisory business called Dakota Ridge Capital. You can learn more about that here.

The second is MacroMashup. Wait. Since this newsletter is free, how can I make money from it?

Great question. Right now, I don’t, but I will very soon. I will tell you how later.

The third is investing. The problem is/was that I was not paying enough attention to that.

I found that out when I filed my taxes. I incur expenses in my investment company that my accountant would not let me pass through as active to my personal 1040 tax return because the losses are not sufficiently active.

Really? They are sitting there waiting for me to get more active in investing.

That was a wake-up call.

I said last week that my financial advisor was not doing a bad job. The problem is they were doing the job I should have been doing.

If you eat out at restaurants all the time, you can eat great food. The problem is that it may not be that good for you. You don’t know exactly what ingredients or how it was cooked.

Often, you may be left thinking, “I could have cooked better at home.” And I paid how much?!

Sure, you must plan the menu and shop for the ingredients. You'll also need to take the time to learn the proper cooking techniques and cook the meal. That takes effort; you may not get it right the first time.

When you do, though…it’s incredibly satisfying.

My Dakota Ridge Capital business is mainly based on my being prepared to do something many people are afraid of: figuring out how to make deals that require a deep understanding of taxes.

A lot of people are not prepared to do that.

Financial advisors do their business in the same way. They know people have jobs and prefer to focus their energy on making the money they invest. “You do your job, and let us do ours!”

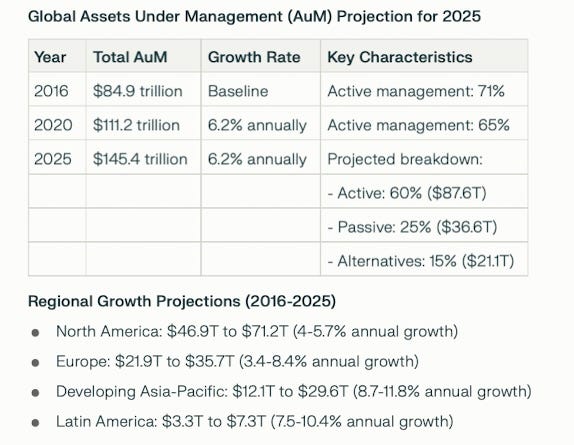

It is a vast industry of financial advisors and asset managers.

At ~1% of AUM, that’s a $1.5 trillion industry—a lot of meals out.

So, I need to get more hands-on, but that isn’t the whole story.

The entire investment landscape is changing.

We have more uncertainty than we have had for a very long time. Here’s the list:

War in Ukraine

War in the Middle East

War between China and the US

$36 trillion of debt growing at a rate greater than the rate of growth of the economy

Fartcoin. $TRUMP coin. $MELANIA coin

Gold is increasing in price even as real interest rates are increasing

Bitcoin is increasing in value even though it is inherently worthless

The US is renaming the Gulf of Mexico, taking back the Panama Canal, considering buying Greenland, and making Canada the 51st state

Seven stocks dominate the S&P 500

The bond vigilantes are waking up and may limit the Fed’s ability to be the bailout of last resort.

If your financial advisor has structured your portfolio around a questionnaire designed to capture your risk tolerance, they have probably given you a 60/40, 70/30, or 80/20 mix.

That is not going to work anymore. Here’s why.

At the end of the year, I wrote down some predictions:

The investment mix was one of the takeaways:

The new paradigm is 30/30/30/10:

30% short-term fixed income

30% value stocks

30% hard asset - real estate, gold, Bitcoin

10% trading

So, how do you fix this?

Here’s what I have done.

I called my financial advisor, saying, “It’s not you; it’s me.” It’s a breakup of sorts.

I set up an account at Interactive Brokers, read reviews, saw the ads on Bloomberg, and asked some people whose judgment I respect.

Then, I initiated an ACAT transfer, which stands for Automated Customer Account Transfer. This means you can transfer assets in kind without selling them and paying tax on the gains.

It’s painful because, in addition to transferring IRAs, I had to move the brokerage accounts held in the investment LLCs.

The IRAs are straightforward, but the LLC is not.

That involves uploading Articles of Incorporation, Operating Agreements, Proof of Business Address, and other forms and proofs.

It takes a while. I had some concerns that Interactive Brokers' customer service might be lacking. It wasn’t; everything has moved across fine.

Do I know enough to manage all this effectively? Am I like the lawyer who represents himself? Does he have a fool for a client?

I am not flying solo. I have some help, but a different kind of help - more like an investment coach. I am going to keep that quiet for now. You can reach out if you’re curious, and we can discuss…

Here’s The Mistake

Paying someone to manage an investment portfolio you don’t understand is acceptable, provided the assets keep growing.

2023 and 2024 were both 20%+ years in the stock market. The odds are not good that 2025 will be the same.

If the assets decline in value, it’s not comforting that your advisor is taking their fee on a reduced AUM.

It’s also not that comforting that your decline may be less than or equal to the market benchmarks by which your advisor is measuring their performance.

It would be even more frustrating if you sensed that things needed to change, but your advisor was not set up to react because you are a tiny part of that $145 trillion.

Or because you did nothing.

The only way to avoid this is to take charge:

Call your financial advisor and have them explain why you own what you own

Ask them what their macro view is and how they are protecting against downside

If you don’t get great answers, make a plan to make a change.

Great Shares

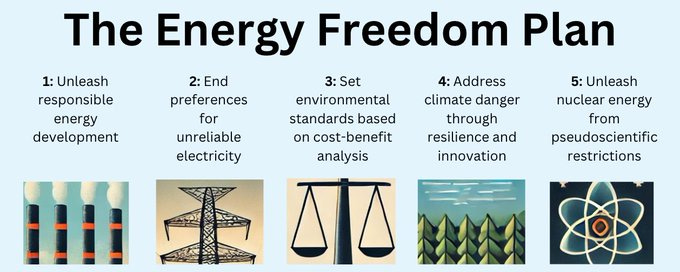

Alex Epstein wrote a great article on X, outlining his recommendations to the newly constituted National Energy Council.

Alex was kind enough to send me a copy of his new book, Fossil Future, when, after reading his first book, The Moral Case for Fossil Fuel, I asked if he would be a podcast guest.

The first book contains this great quote:

“We don’t want to save the planet from human beings, we want to improve the planet for human beings”

For those of you who have a hard time saying “no,” this post from Dr. Deborah Hall is priceless

If you want to dig in and understand commodity investing, start with listening to Rick Rule on gold.

On The Horizon

Book loaded into Amazon and I am proofing the paperback next week!

Stay tuned…

Check out the podcast intro music - coming in February

Quote of the Week

From Dave Chapelle, hosting the first Saturday Night Live of 2025 with a monologue of 17 minutes, the longest in SNL history, breaking his record from November 7, 2020.

“Do not forget your humanity. And please, have empathy for displaced people, whether they’re in the Palisades or Palestine.”

As we approach 4-years, where political acrimony may reach new highs, it’s worth remembering.

Four Ways To Support MacroMashup

If you are interested in clean energy investment advisory services, book a complimentary call here

If you wish to see even more content from MacroMashup, check out our podcast (coming in February).

If you'd like me to be a guest on your podcast or guest blog about clean energy or macroeconomics, send an email to contact@macromashup.com

If you enjoy this newsletter, do me a favor and share it with a friend by sending them this link www.macromashup.com

This is my first read of your newsletters and I really enjoyed it. You cover a lot of ground in a down to earth way. It's important for us to realize things have changed. I'm jumping to the most current article now. Curious to see where the conversation has taken us.

Like the Rick Rule video insert, how he said/reasoned around min 13 when he talks about $PPP was interesting, I’ll watch the whole thing tomorrow