Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 7 minutes. Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives, so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

Macro Snapshot/Current News

The Press Conference

From high society to the ski slopes, this week's only topic was the wretched press conference with Zelenskyy.

Here’s the range of reactions:

Trump and Vance were bullies acting deplorably, telling Putin’s lies about who started the war

Zelensky was disrespectful and acted foolishly. He should have just made nice, signed the minerals agreement, and gone to lunch

Zelensky should have shown up in a suit and tie and let the press corps ask whatever (planted) questions they wanted without taking the bait.

As appalled as most of the pundits were at this sh*t show, the American public was evenly divided about the outcome.

Do we have a Manchurian Candidate in the Oval Office, doing Putin's bidding? Or do we have a new-age realpolitik President prepared to say uncomfortable things out loud?

Zelensky is now prepared to sign the agreement at any point convenient to President Trump. The following keeps happening:

Presidential Joint Address

This address (not State of the Union) was nearly 100 minutes long. I find it easier to watch the President at 2x speed.

Here are the takeaways:

America is back, and we are about to witness a new Golden Age

Joe Biden was probably the worst President ever

Elizabeth Warren (calling her by his favorite pet name, Pocahontas) might want to continue the war in Ukraine for another five years - but he intends to end it

While Democrats said they needed legislation to seal the border, it turned out that we just needed a new president

DEI and woke is gone; men are men, and women are women, good just the way God made them

English is the official language of the U.S.

The Gulf of Mexico is now the Gulf of America

We are getting Greenland one way or another…

The Panama Canal was given to Panama, not China - we are taking that too

Law enforcement needs all the support it can get (including, presumably, some help from the pardoned and released January 6th rioters…)

The tyranny of unelected bureaucrats is over…but Elon is doing a great job

Taxes are going down, and the green new scam is over

We are going to be protected by a Golden Dome - sounds a lot like Ronald Reagan’s Star Wars

Many Democrats wore pink and held up protest signs like paddles at an auction

He believes God saved him in Butler, Pennsylvania to make America great again.

And he promised to balance the budget.

In The Markets

Markets are getting bumpy

We will need to get used to this. When Joe Biden ran for office in 2020, one of his promises was to keep the Presidency off the front page of the news. He said people were tired of the drama. In this, he succeeded (mostly).

Donald Trump will never be far from the front page, and some of the things he does will feel like:

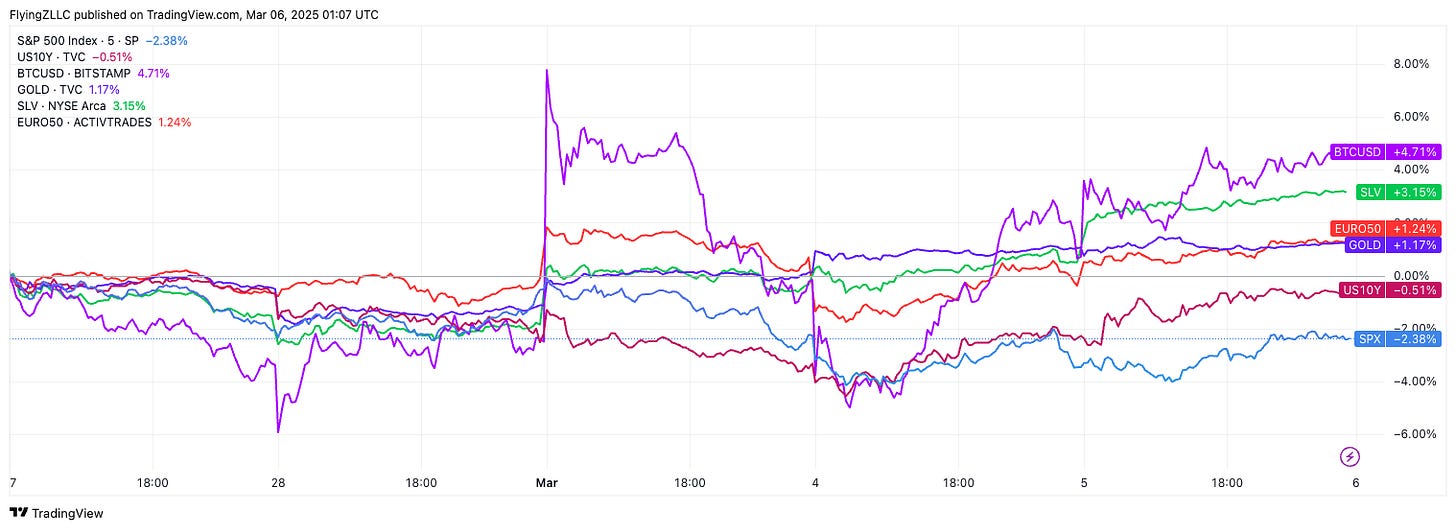

Here’s what that looks like in a chart:

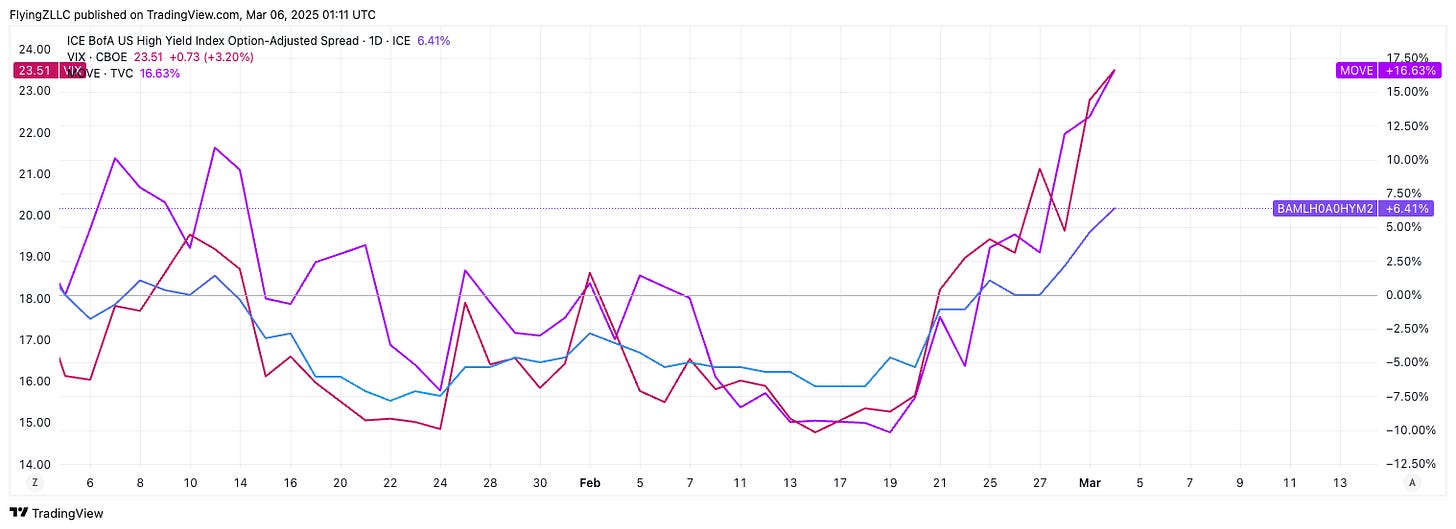

VIX (stock market volatility index), MOVE (bond market volatility index) are as high as they have been all year.

Credit spreads are beginning to march higher.

Technical Analysis

Some of you may remember that I set out to explore the world of technical analysis a few months ago.

Charts map the past. They don’t predict the future. Their value consists in pattern recognition. They are all about price and volume. Price contains the wisdom of millions of trades: buyers and sellers expressing their opinions on the value of everything being traded.

Here’s what I’ve learned so far:

Interactive Brokers has a decent charting capability - I’m still exploring

Trading View has a fantastic charting capability

Charting is a great way to compare how securities perform over given periods in varying economic circumstances

There may be multiple ways to get exposure to a particular risk - charts allow you to compare how different securities offering that risk perform relative to each other

There are many indicators designed to help you weigh the performance factors and see how the voting machine is working - I will focus on one.

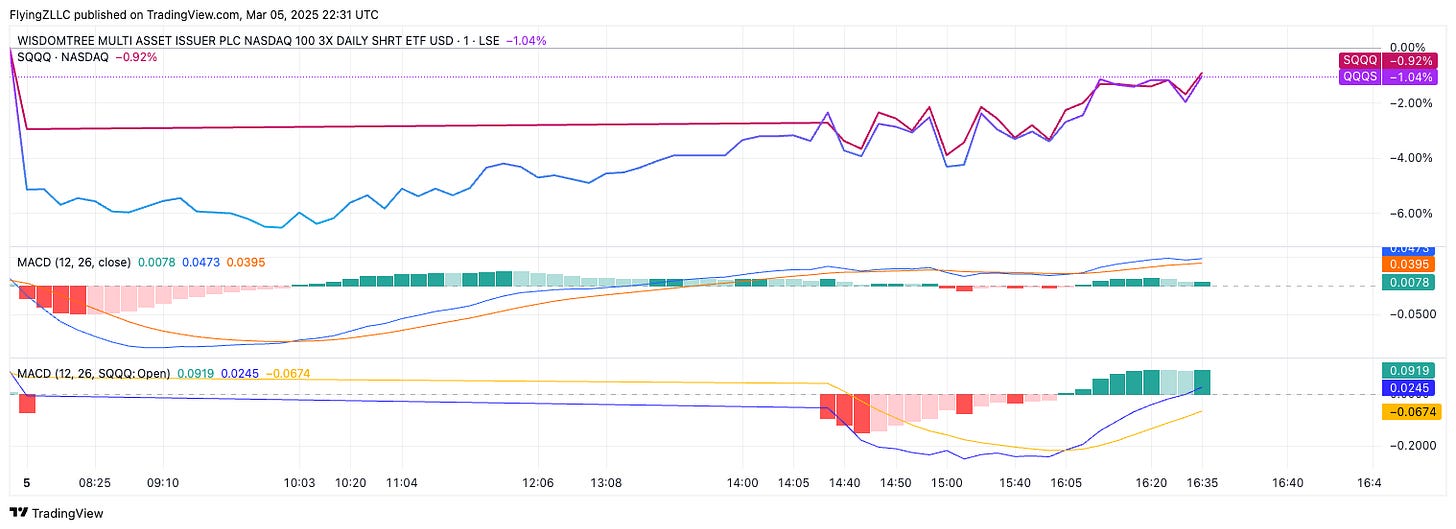

MACD

Moving Average Convergence Divergence is one of the most popular charting tools.

MACD employs two moving averages of varying lengths to identify trend direction and duration. Then, MACD takes the difference in values between those two moving averages (MACD Line) and a moving average of those moving averages (Signal Line) and plots that difference between the two lines as a histogram, which oscillates above and below a center Zero Line. The histogram is used as a good indication of a security's momentum.

The above shows two securities, two ETFs, one based in London, the other in New York. Both aim to expose the investor to downturns in the NASDAQ, leveraged/amplified 3x. Both are intended to hedge the NASDAQ.

The first challenge is to remember which line is which. Try this: “B(ig)Mac” stands for Blue line—that’s the MACD Line. When it crosses the orange signal line going up, it is bullish. It is a measure of positive momentum.

Traders and investors seem to like this. Moving averages smooth price charts and the methodology of the MACD is a good signal of buy-sell momentum. I watch it a lot.

Must-Read Piece(s) on Today’s Market

I am linking just one article this week because it is long. Victor Davis Hanson of The Free Press does a great job of breaking down what is at the root of the current administration’s policy.

For those with staying power or a good AI tool, enjoy!

And, of course, if you are itching to see the entire Joint Address, here it is. Remember, 2x is the max!

On The Horizon

Congress must vote to avoid a government shutdown by March 14th

Greenland holds elections

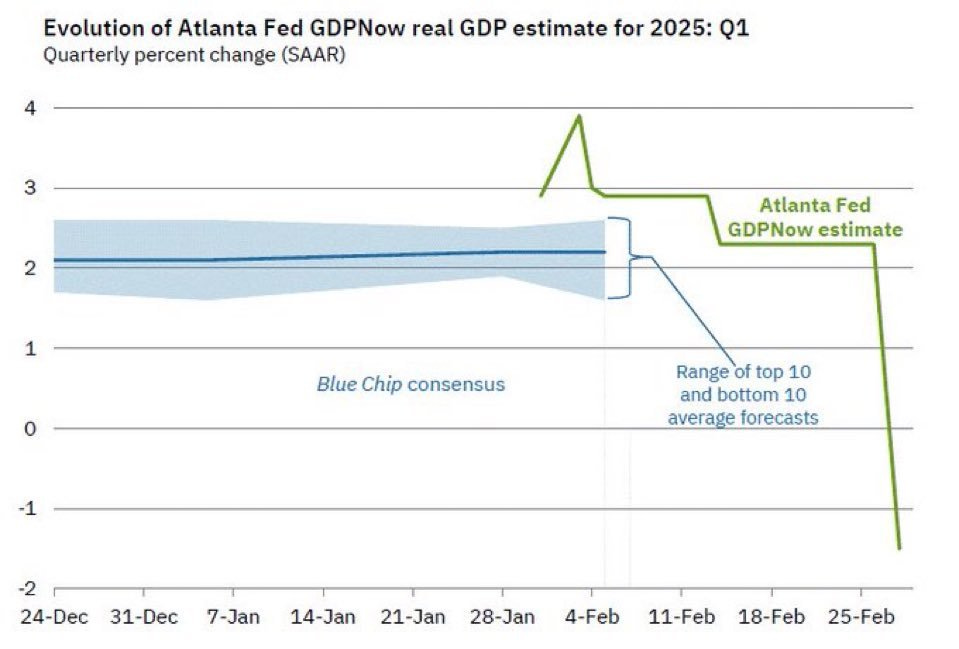

The market begins to wonder about the FOMC meeting on March 18th - interest rate cuts are now very much on the table because of this chart from the Atlanta Fed showing the economy cooling rapidly (thank you DOGE…)

Five Ways To Support MacroMashup

If you are interested in clean energy investment advisory services, book a complimentary call here

Please subscribe to our new YouTube channel - or support our audio podcast by following us on Spotify or Apple - we appreciate your support!

If you'd like me to be a guest on your podcast or guest blog about clean energy or macroeconomics, send an email to contact@macromashup.com

Share this newsletter on X here

If you enjoy this newsletter, please email it to a friend by clicking on the button below.

Regarding charting, the Schwab charting and stock analysis tools are excellent.

On the topic of the NASDAQ, it is my impression that the investment community often do not have a grasp of the the underlying technologies of technology stocks traded on the NASDAQ. For instance, many small and mid caps who build electronics technologies have been downgraded by many investment firms in the last year. There is the thinking that with the pull back in the EV market that the demand for electronics will be pulled back. What they these investment houses don't seem to realize is that most of these electronic component technology companies are diversified and don't sell exclusively into the EV market. Their products are also used in data farms and in industrial equipment.

Charting is one method to evaluate stocks, but price to earnings matters. Sales matter. Debt matters.

Regarding Trump, I've mostly tuned him out. Navarro and Musk also seem somewhat incoherent. Good on cutting some questionable federal contracts there were approved under Biden, but this won't fix the debt or the deficit. I doubt that Trump, Navarro, or Musk have a real plan to deal with the deft and deficit. But, hey, we're still going to Mars. So what is the real intent of Trump, Musk and Navarro? It doesn't look to me that they are serious about confronting the debt and deficit or making hard decisions about how to defend the manufacturing base of the US.

For sure, putting tariffs on Canadian made auto parts will increase the price of US vehicles (Ford and GM). It won't be easy for Detroit to back out the part of their manufacturing base that is in Ontario, Canada.

Trump says he doesn't care about tanking the economy? Well, I suspect this tune will change as the mid terms approach in under two years.