Surviving The Everything Bubble: Five Strategies For Success

...and remember to pack fireworks when you go skiing at night...(Great Shares)

Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 7 minutes. Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives, so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

Five strategies to navigate the everything bubble:

Be aware that you are in one. In 68 years, the longest win streak for the S&P 500 above 20% is 5 years:

No NFL team has ever won three consecutive Super Bowls…

Express your view of markets in your investment portfolio or have a detailed conversation with your financial advisor about risk management.

Don’t believe the 60/40 portfolio mix. The idea that bonds go up when stocks go down does not work in a more inflationary environment. In 2022, both stocks and bonds declined.

The stellar stock market returns over the last few years have been heavily influenced by the vast amount of liquidity the Federal Reserve has supplied. However, that liquidity is reducing as the government and corporate America start to refinance their debt maturities.

Consider rebalancing away from the Mag 7 and increasing exposure to stocks and commodities that offer an inflation hedge, which will benefit from the onshoring of manufacturing to supply energy needs and will rise if the broad market hits an air pocket.

Macro Snapshot/Current News

Deficits & DOGE

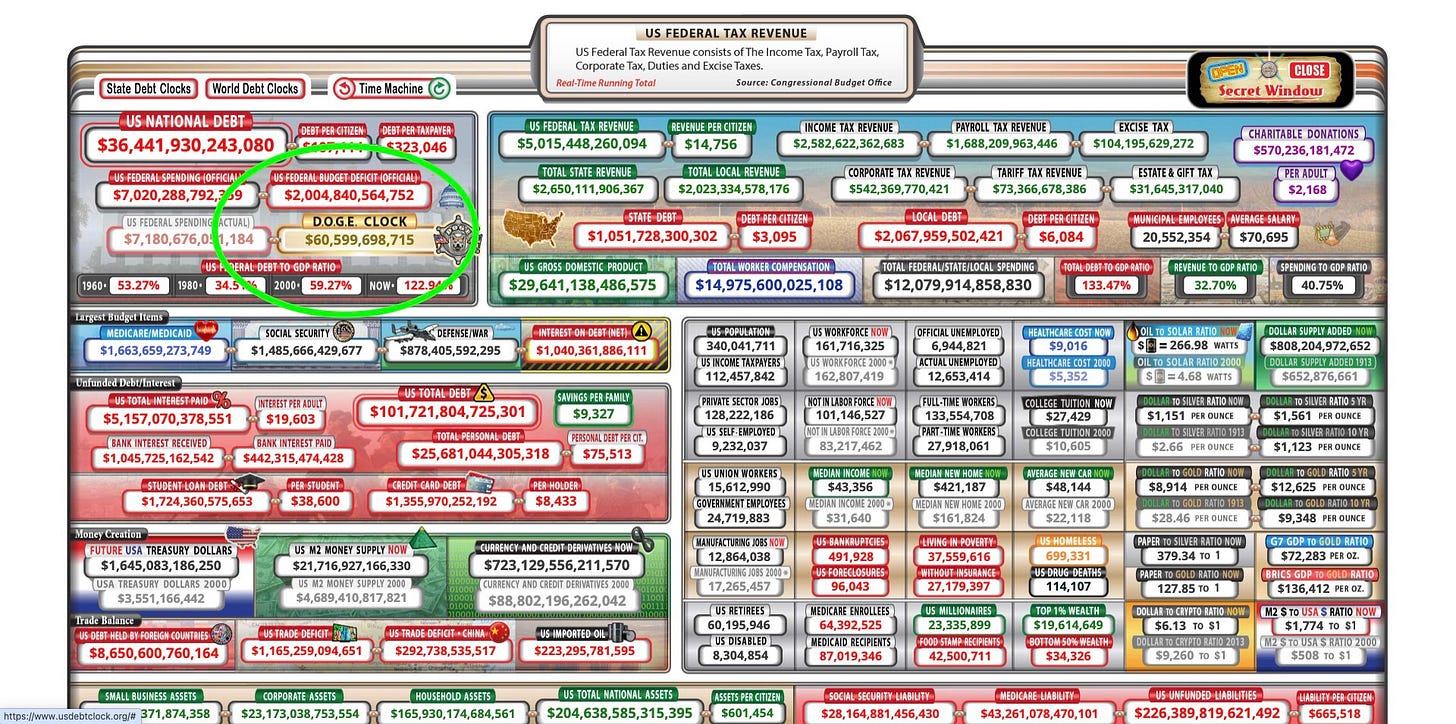

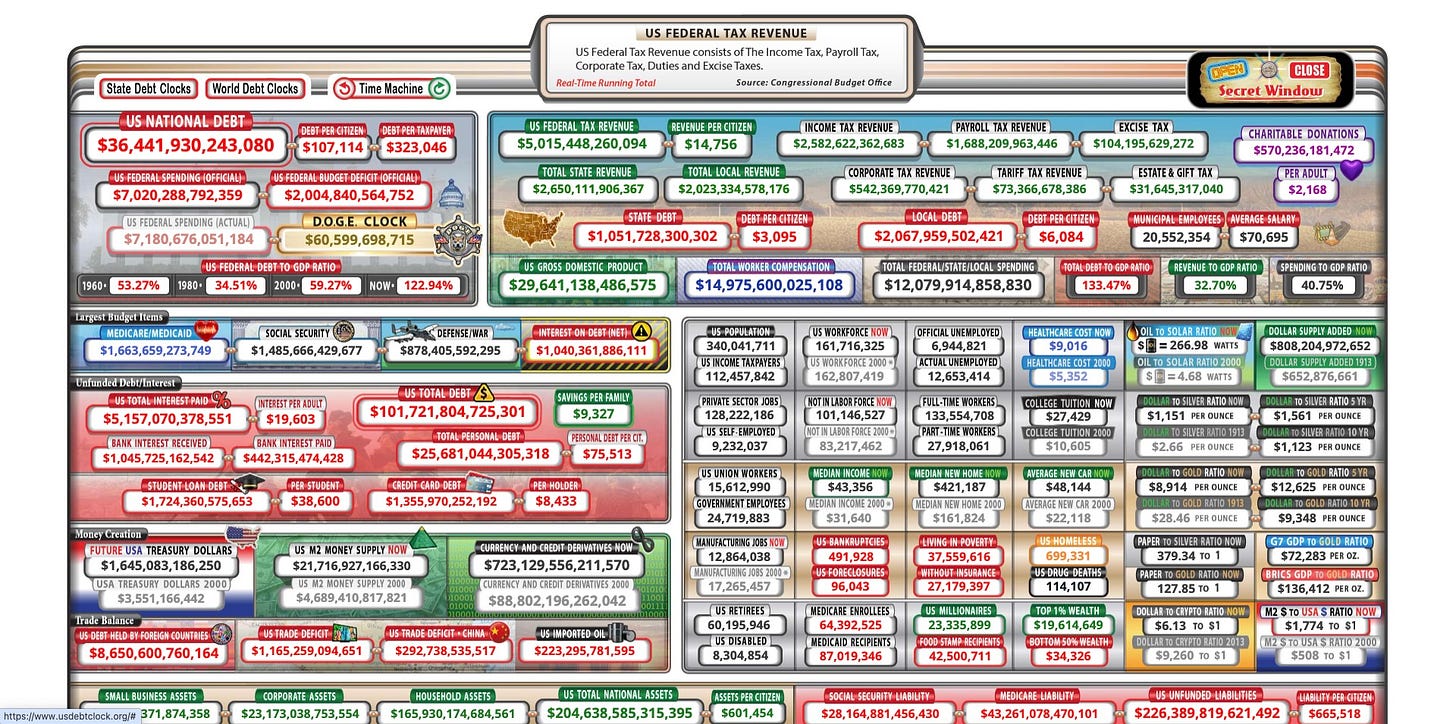

Elon Musk claimed that DOGE would reduce the deficit by $1 billion/day. This handy overview provides a great snapshot of the US and has a separate section just for DOGE to track progress.

(I have included a clickable link to this in Great Shares below).

So far, 15 days in, the rate is $4 billion daily. If DOGE keeps up this pace, we will be on track to reduce the annual $2 trillion deficit by around $1.4 trillion this year. Half this rate would be significant progress.

The most widespread DOGE outrage in the media has been over USAID. The title suggests overseas aid. What it stands for is the US Agency for International Development.

Its budget is between $40 and $50 billion, compared to the State Department's budget of $58 billion. The outcry has been based on the assumption that shutting down USAID would be a humanitarian tragedy.

USAID has indeed provided an enormous amount of humanitarian aid. It has also assisted and financially supported countries and other causes that offend the Trump administration.

So, the proverbial baby is being thrown out with the bathwater (or, as the conspicuously un-empathetic Elon Musk said, “thrown into the wood chipper”). Senator Brian Schatz has suspended all State Department nominees until USAID is restored.

Maybe Congress can now review—as it should—whether an executive order can shut down a government department.

If you want a short post on the pros & cons, I have included a post from Stu Turley’s Energy News Beat (Great Shares).

Information to Action Ratio

A subscriber brought this to my attention. Neil Postman discusses this concept at length in his influential book, Amusing Ourselves to Death.

The idea is that a high ratio, where information massively outweighs the ability of the consumer of that information to act on the information received, creates an impotence loop where people feel overwhelmed by information and powerless to act.

This is a great point to remember as the current administration floods the zone with a daily tsunami of Executive Orders and statements designed to move the Overton Window to now include:

- renaming the Gulf of Mexico to the Gulf of America

- the retaking of the Panama Canal

- annexing Canada as the 51st state

- purchasing Greenland

- taking charge of and redeveloping Gaza

- imposing tariffs on Canada, Mexico, and China (I included a link to a different take in Great Shares below).

None of these are anything the average citizen can do anything about and, if you allow them to, will drive a frustrating information-to-action ratio even higher.

What Action I Am Taking?

As I have mentioned, I moved our family investment portfolio out of the hands of a JP Morgan advisor and into Interactive Brokers. Why does that matter?

As a small part of a large advisory platform, paying 1% for the management of the funds, you can do little to express your views on the direction of markets by adjusting the investment mix.

You get the house view, for the most part. I didn’t see it change much to reflect the current macroeconomic and geopolitical shifts I am watching.

I don’t think we should expect the broad stock market indices to enjoy the kind of 20%+ returns they have earned over the last two years (see #1 above).

The information-to-action ratio was very high. I didn’t like that.

Having moved the assets into Interactive Brokers, I control the investment mix. I hired an investment coach because I don’t have much experience as a DIY investor.

Like my strength coach, he sets up a program based on a proven system and gives guidance, but I have to execute. Right now, I am repositioning the portfolio.

I currently have 90% of the assets in cash. The other 10% are positions I will keep and increase: gold, uranium, and gold miners. Lowering the information-to-action ratio feels good.

In The Markets

The markets survived the DeepSeek scare last week, and they have survived the tariff announcement this week.

- The S&P has been bouncing around but still trades at above 6,000

- The Ten-Year Treasury has been doing well and trading below 4.5% for the first time since mid-December.

Scott Bessent’s first Quarterly Refunding Statement (outlining Treasury issuance for the next quarter), was well received because he is continuing his predecessor’s bias towards issuing more at the short end of the curve.

The market had concerns he would want to skew issuance to the long end, which would potentially have pushed long rates up.

- Economic indicators have been mixed: strong reports on the services sector and weaker on manufacturing.

- Productivity has improved - which should help inflation.

- No material increase in jobless claims.

- Friday, February 7th, will report nonfarm payrolls - consensus 169,000 - and the unemployment rate - consensus 4.1%.

- There will also be an update on consumer sentiment from the University of Michigan.

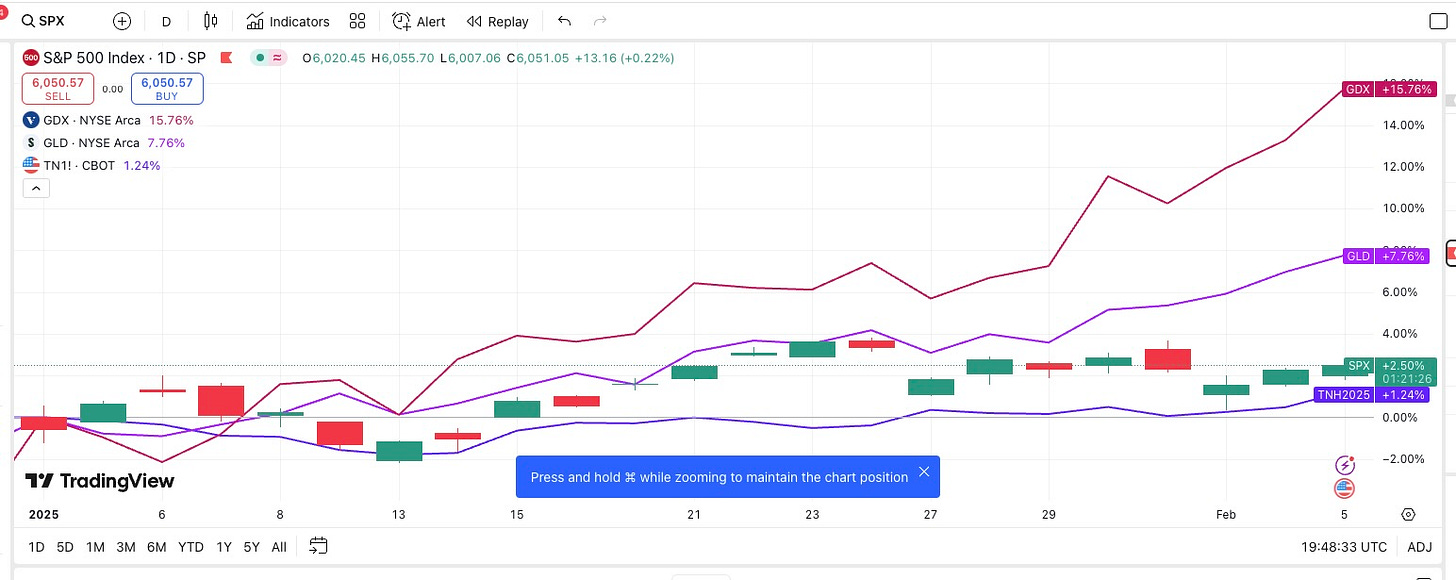

The chart below is likely to continue for the remainder of the year. The S&P 500 shows modest growth, with gold and gold miners (together with other parts of the precious metals complex—silver primarily) doing much better.

This reflects concerns about inflation and foreign central banks' steady accumulation of physical gold.

(The bottom line is the S&P 500; the middle is gold, and the top is a gold miner ETF).

Great Shares

The US Debt Clock site is a true rabbit hole of mind-blowing information. You can dig into states, other countries, and a time machine back to 1980 to compare where we were then - enjoy!

If you want a succinct review of the pros and cons of USAID, this quick newsletter from

is great:This is another take on tariffs. We hear a lot about how the US is about to isolate itself from world trade and how tariffs are inflationary. We have another 20+ days to find out.

And, for those of us who pay attention to technical analysis…

On The Horizon

Key events for next week. Not as many as this week but very significant.

Wednesday, February 12:

U.S. Consumer Price Index (CPI): The primary focus of the week. This inflation report will provide insights into how price pressures are evolving and could influence Federal Reserve policy decisions.

Fed Chair Powell Testimony: Powell is expected to testify before Congress, providing updates on the Fed’s economic outlook and monetary policy stance.

Thursday, February 13

UK GDP Report: A key indicator of the UK’s economic health.

U.S. Producer Price Index (PPI): This report will reveal inflation trends at the producer level, complementing the CPI data from earlier in the week.

Quote of The Week

“Every action you take is a vote for the type of person you wish to become” - James Clear (Author of Atomic Habits).

Don’t Try This Yourself

We will be watching this extravaganza this weekend. Who ever thought strapping a backpack full of fireworks, lighting them and skiing downhill at night was a good idea? (Steamboat Springs Winter Carnival).

Four Ways To Support MacroMashup

If you are interested in clean energy investment advisory services, book a complimentary call here

If you wish to see even more content from MacroMashup, check out our podcast (first episode in editing)!

If you'd like me to be a guest on your podcast or guest blog about clean energy or macroeconomics, send an email to contact@macromashup.com

If you enjoy this newsletter, do me a favor and share it with a friend by clicking on the button below.

Any thoughts/predictions about Sunday’s election?

Lots of great content, need to re-read, thank you in the meantime though