The Rapidly Shifting Geopolitical Landscape - Three Eye-Opening Examples

There are decades where nothing happens and weeks where decades happen.

Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 7 minutes. Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives, so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

Macro Snapshot/Current News

Major U.S. - Europe Reset

Last week was a watershed week for U.S. relations with Europe:

Vice President J.D. Vance gave speeches in Paris (warning about the overregulation of AI) and Munich (warning Europe about limiting free speech by right-of-center parties).

Defense Secretary Pete Hegseth, at a gathering in Brussels, stated that Ukraine’s aspirations to join NATO and return to pre-2014 borders (before Russia seized Crimea) were unrealistic.

President Trump set up negotiations with Russia that will not involve other European nations or Ukraine.

In response, on February 17th, French President Macron convened an emergency summit of key European leaders—Germany, Spain, the U.K., Denmark, the Netherlands, Italy, and Poland—but conspicuously NOT Hungary.

The summit's goal was to figure out how to respond to the perceived shift in the support provided in the past by the U.S. Hungary was excluded because of Viktor Orban’s perceived closer allegiance to Russia.

The clear signal from Hungary’s exclusion and the inclusion of a non-EU member, the U.K., is that a non-EU response involving a core group of aligned nations may be necessary. Hungary would presumably veto any proposals threatening Russian interests.

What Does This Mean?

It means precisely what President Trump says it means. He wants to bring an end to the War between Russia and Ukraine, and, in this, the interests of the U.S., as he sees them, are not fully aligned with those of Europe.

As I noted in last week’s newsletter, the growing closeness of the alliance between Russia and China, triggered by the Russia-Ukraine, is very uncomfortable for the U.S.

Russia can supply China with the commodities it desperately needs. Even though Russia sells at a discount, it raises hard currency in gold and avoids the sanctions placed on it by Europe and the U.S.

Russia’s economy is on a war footing, and on a purchasing power parity basis, it is spending more on munitions than all of Europe combined. China is clearly able to outproduce the U.S. in munitions and is a significant component of the U.S. military supply chain.

The U.S. cannot logistically continue to supply the war in Ukraine and needs to switch focus to shoring up its defense capabilities to meet the imminent challenge from China. It is unlikely that Trump will say this part out loud.

European leaders rightly suspect that Trump may be prepared to offer Putin concessions that meet the United States' unstated needs.

In response, they are rapidly concluding that they must assume the role of primary guarantors of their security. This may be precisely what Trump wants—until he realizes that Europe’s reduced dependency on the U.S. will inevitably lead to a decline in U.S. influence.

In The Markets

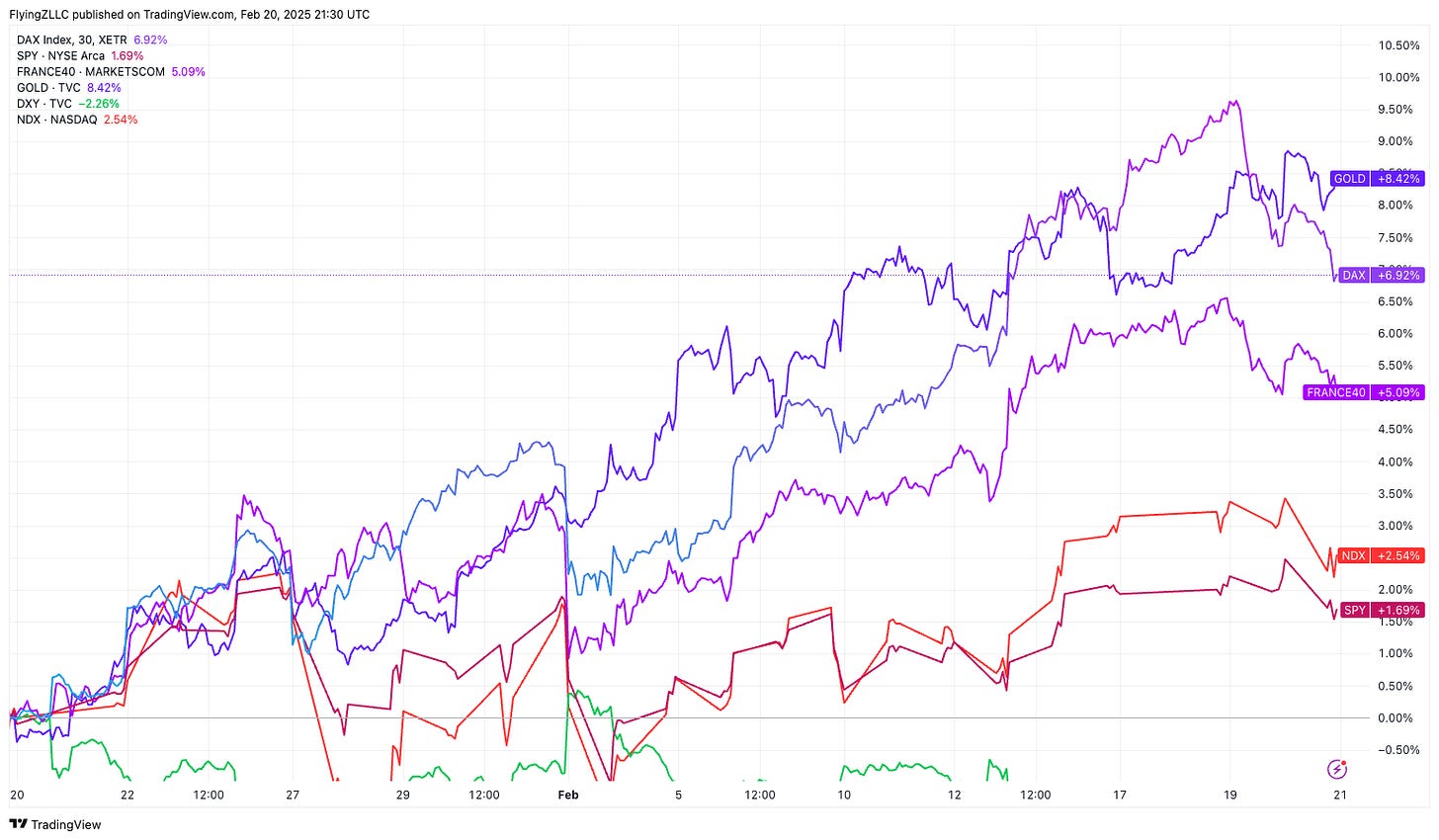

The above provides the context. The examples of how this is playing out in markets are as follows:

Example 1

Historically, as the U.S. ran trade surpluses with the rest of the world, it exported USD in payment, which was reinvested into U.S. treasuries and the U.S. stock market.

With his message on tariffs, Trump is telling the rest of the world that they must reverse the surpluses and buy U.S. goods and services instead.

The markets interpret this as relatively better for non-U.S. stock markets - see the chart below. Every foreign market shown performs better than the U.S., and the USD is weakening. The expectation is that increased capital flows to markets other than the U.S. will bolster values in those markets.

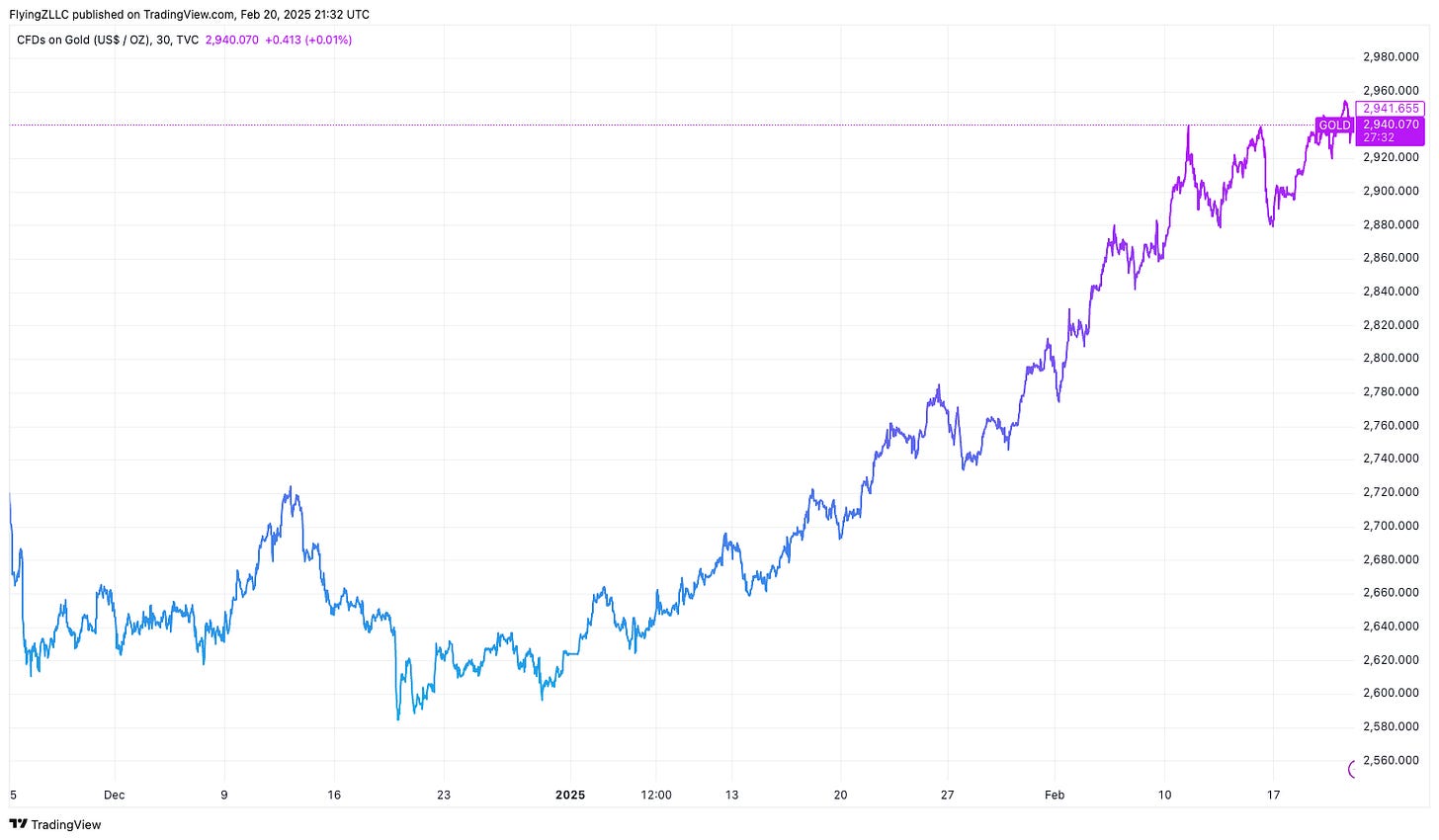

Example 2

Gold is beginning to assume a role not seen since President Nixon removed the U.S. from the gold standard. Post-Bretton Woods, the USD became de facto the world’s reserve currency.

Until 1971, it was pegged to gold. Even after the peg was removed, the currency continued to dominate. However, this is changing.

Since the war in Ukraine and the freezing of $300 billion of Russian assets, world central banks have begun accumulating increasing amounts of gold as an alternative reserve asset not vulnerable to U.S. sanctions.

The U.S. is laying the groundwork for an increased role for gold in financing the country’s fiscal deficit, an inevitable consequence of the policy outlined in Example 1.

The revaluation of the 261.5 million ounces of gold in the Federal Reserve System from $42 to its current market value would create an additional $800 billion in borrowing capacity, independent of foreign creditors - simply from the unrealized gain being realized.

Former Fed governor nominee Judy Shelton has begun discussing the prospect of U.S. Government bonds being issued backed by gold.

In anticipation of a revaluation by the U.S., and because of concerns about the imposition of tariffs, physical gold is beginning to move rapidly from London to New York - on commercial planes (see below Great Shares).

The era of USD dominance is drawing to a close. Gold's role is growing, and its price reflects this. Treasury Secretary Scott Bessent is fully aware of this.

Example 3

Treasury Secretary Scott Bessent’s “Three Arrow” policy is:

Grow GDP by 3% per annum

Reduce the budget deficit to 3% of GDP

Grow energy production by the equivalent of 3 million barrels daily through increased oil, gas, and renewable energy production.

If the era of shale is ending (very likely), this will be challenging (see the report by Goehring and Rozencwajg below—Great Shares).

An initiative to support Bessent’s 3-3-3 policy, recognizing the challenges of oil production, is the bipartisan Nationwide Consumer and Fuel Retailer Choice Act of 2025, introduced in the Senate by Senators Deb Fischer (R-NE) and Tammy Duckworth (D-IL). This bill has support from other senators across party lines, including Chuck Grassley (R-IA), Amy Klobuchar (D-MN), and Tammy Baldwin (D-WI).

The bill would allow E15 (15% ethanol gasoline) to be sold year-round without the need for summer waivers.

The effect would be to increase the amount of oil equivalent barrels per day from corn-based ethanol by up to 450,000.

The chart below shows the market reaction to the corn price. It’s a smart way of ‘growing’ the increased energy production but reflects the reality of shale production rolling over. It’s also a trading opportunity…

The Rest of the Market

- The S&P 500, while not trading as well as non-US stock indices, has continued to make all-time highs

- !0-Year Treasuries have tightened from 4.6% to 4.5%

- BTC has stayed steady in the $95-98k range

- Credit Spreads have continued tight, suggesting no trauma in the markets yet.

Great Shares

A Wall Street Journal article describes how gold bars are shipped from London to New York on commercial flights (click on the picture below).

Judy Shelton's article in the New York Sun (click below) talks about the issuance of gold-backed Treasuries.

Natural Resource investment experts Goehring & Rozencwajg discuss the secular decline of U.S. oil and gas production in their December 2024 quarterly review (click the logo below).

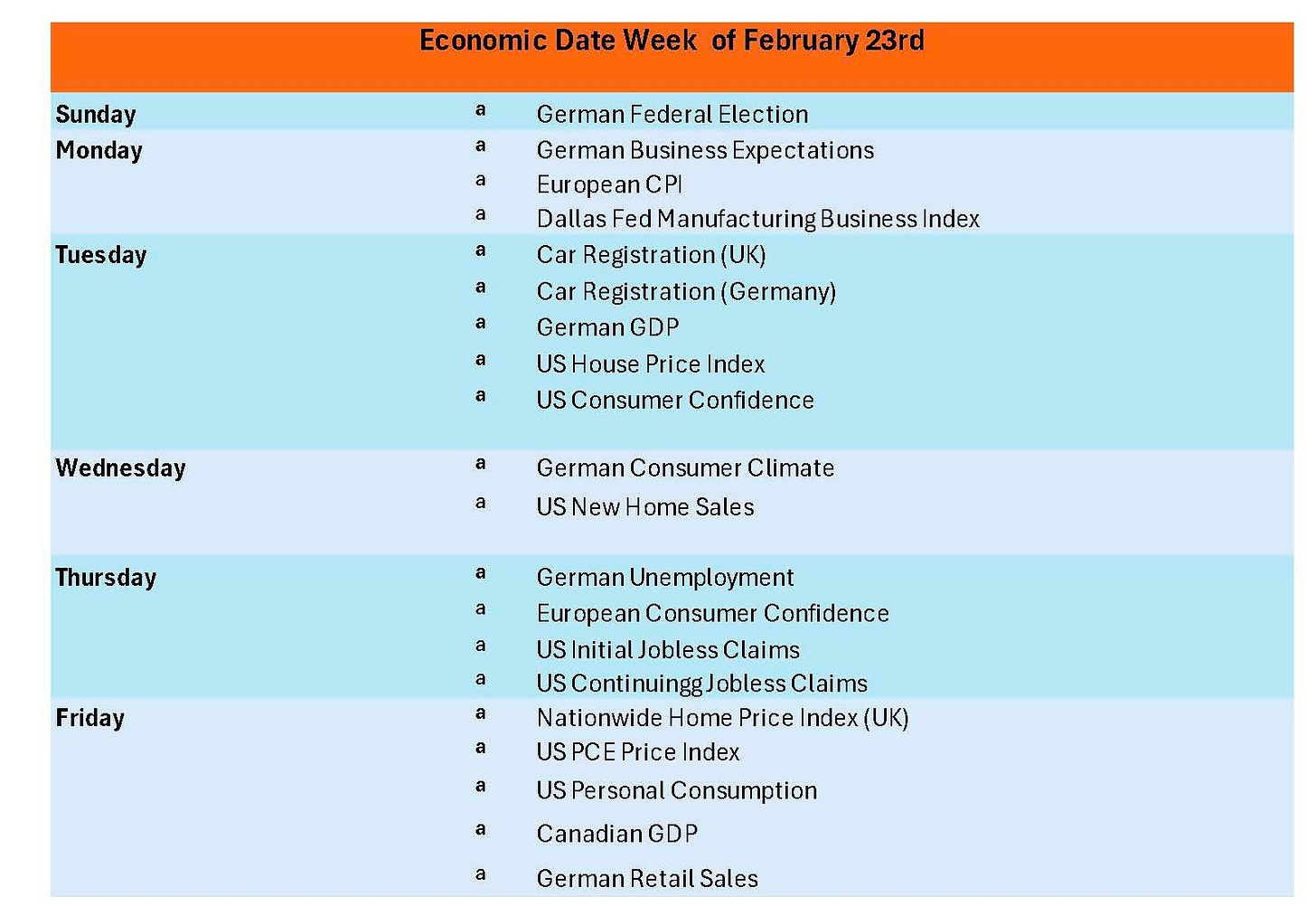

On The Horizon

The German federal election on Sunday is significant for a few reasons:

The election was called early after Chancellor Olaf Scholz’s coalition government of the SPD, Greens, and FDP collapsed in December 2024 due to irreconcilable budget disputes and a failed confidence vote. This marks the fourth snap election in Germany’s post-war history.

Germany is experiencing heightened political polarization. The far-right Alternative for Germany (AfD) polls at a record 20–22%, making it the second-largest party in some surveys. This has sparked debates about immigration and security, especially following recent violent incidents involving migrants.

The center-right CDU/CSU, led by Friedrich Merz, is expected to win the most seats but faces challenges in forming a coalition due to its refusal to collaborate with the AfD.

Germany’s economy has contracted for two consecutive years, with high energy costs and competition from China eroding its industrial base. Voters are deeply dissatisfied with living standards, making economic recovery a central issue for the next government.

As Europe’s largest economy, Germany’s election will have far-reaching consequences for EU policy on economic recovery, defense spending, and migration. The CDU/CSU’s platform includes reducing economic dependence on China and increasing NATO contributions.

It is worth checking in with this in light of the speeches given by Vance and Hegseth and the emergency conference convened by Macron.

Quote of The Week

“Europe must step up as a security provider, not just for itself but for its partners. The challenges we face demand unity and decisive action.” - European Commission President Ursula von der Leyen

Four Ways To Support MacroMashup

If you are interested in clean energy investment advisory services, book a complimentary call here

Please subscribe to our new YouTube channel - or support our audio podcast by following us on Spotify or Apple - we appreciate your support!

If you'd like me to be a guest on your podcast or guest blog about clean energy or macroeconomics, send an email to contact@macromashup.com

If you enjoy this newsletter, do me a favor and share it with a friend by clicking on the button below.

Thanks - weird to see US voting alongside Russia and North Korea at UN, but UN is not a reliable arbiter anymore - it has been a consistent critic of Israel. So US is being consistent in that respect I suppose

Great post Neil. I really like your explanation of Trump's behavior in relation to Russia and Ukraine. I still hate what is happening, but it makes more sense in the broader context of the USA's accelerating conflict with China.