Let’s Blow The Trumpet

I’ve said before: there is too much debt, and we will never repay it.

So, we may as well forgive it.

It’s called a Jubilee and has a rich Biblical tradition, detailed in Leviticus 25. What’s it about?

It’s about cycles of growth followed by taking a breather. Every seventh year, agricultural land is supposed to be left fallow to rest - a Sabbath year. The world was created in six days, and rest was mandated on the seventh day.

Debts were to be forgiven every 50th year—really seven Sabbath years plus one. The rationale was that, absent such forgiveness, the debtors would end up working for the creditors, and wealth would flow to an increasingly narrow group of society.

Instead, a Jubilee year was to be signaled by the blowing of a trumpet. The debtors would be released to more productive labors than satisfying their creditors.

Moral Hazard & Fairness

Debt forgiveness is not popular - except with the debtors. It creates moral hazard and is deeply unfair…maybe.

The miracle of compounding tells us that 7% money doubles every ten years. The rule of 72: divide 72 by your interest rate to find the years it takes your starting investment principal to double.

That doesn’t work in a zero-interest environment. Lots of things get distorted by zero interest rates.

We can start to relate to this concept in the current interest rate environment. Interest rates of 5-6% are much more normal. While the stock market climbs a wall of worry, you can, if you have doubts about its upward to the right trend, put your money in 5.5% Treasury Bills and wait.

Using this philosophy, a creditor will, at rates of 5%, after 50 years have earned 11.5x their initial loan principal by the time it is forgiven.

Thought of another way, the future value of the initial $100 loan principal in 50 years will, at a 5% interest rate, be $8, easily offset by the average of $21 per annum earned by the creditor.

Crop Yields, Fertilizers, and the Federal Reserve

We live in an economy increasingly shackled to the belief that the Federal Reserve can fix everything:

Is inflation too high? Adjust interest rates.

Is liquidity constrained? Use quantitative easing (QE) to get cash into the economy.

Is the bond market constrained? Federal Reserve can extend QE to corporate bonds.

Is recession looming? Fed cuts interest rates.

Are interest rates at zero? More QE.

Is jobs data soft? Fed cuts rates.

We are close to believing that the usual business cycle has been abolished. A new Fed world order has dawned.

We may be close to forgetting that business cycles have a purpose. They correct the excesses that have built up over a growth cycle. We had recessions in the past.

They are healthy, if painful. We were getting ready for a recession in 2019, a normal part of the cycle…and then Covid-19 turned everything upside down.

Fed intervention is like fertilizer: it appears to work miracles, but it can deplete the economy's natural robustness. Crop rotation and leaving the occasional fallow year are still viable tools, and many farmers consider them more sustainable than complete dependence on fertilizer to boost crop yields.

Beautiful Deleveraging

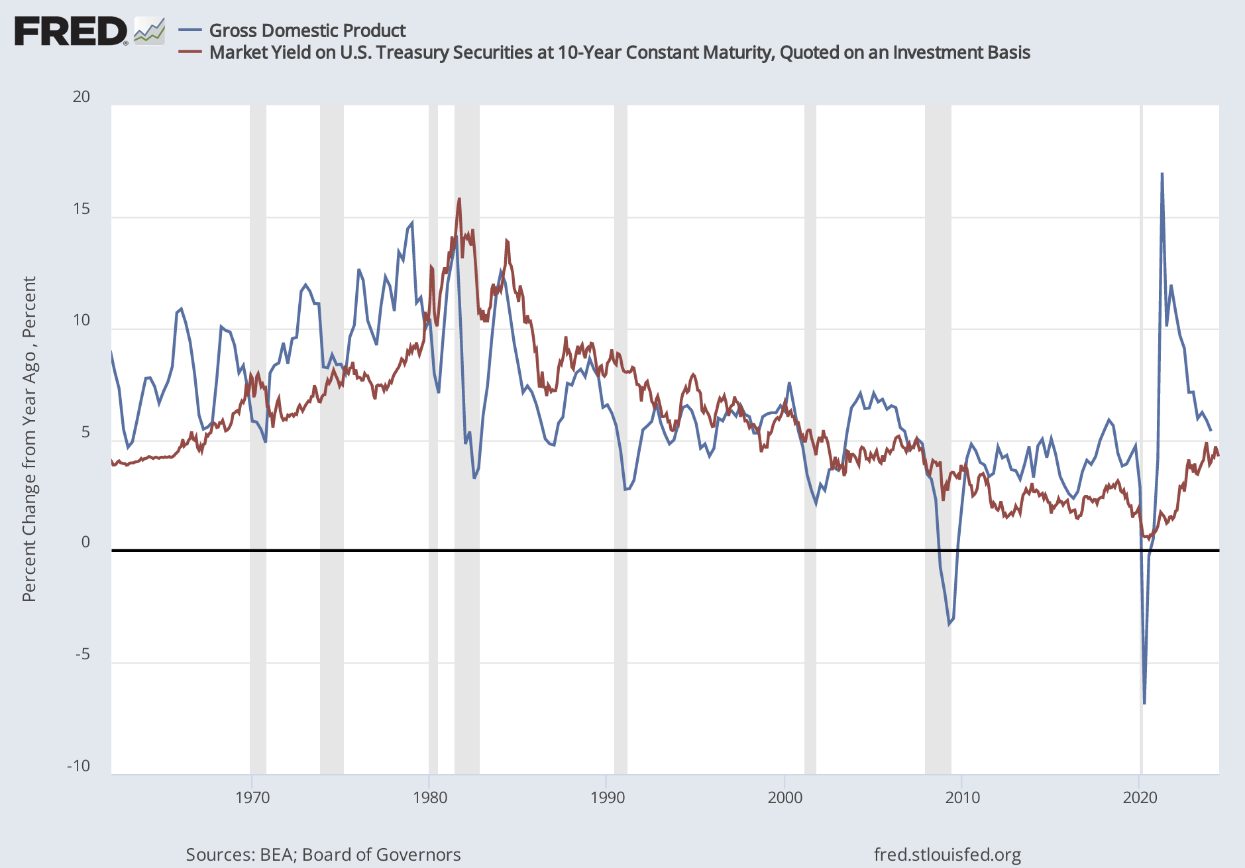

I have also discussed this before: the notion that inflation will erode the value, in inflation-adjusted terms, of the government debt relative to nominal GDP.

It’s just another way of looking at the rule of 72. If the government debt pays interest at 5% and inflation is running at 7%, the real value of the principal invested is declining at 2% per annum.

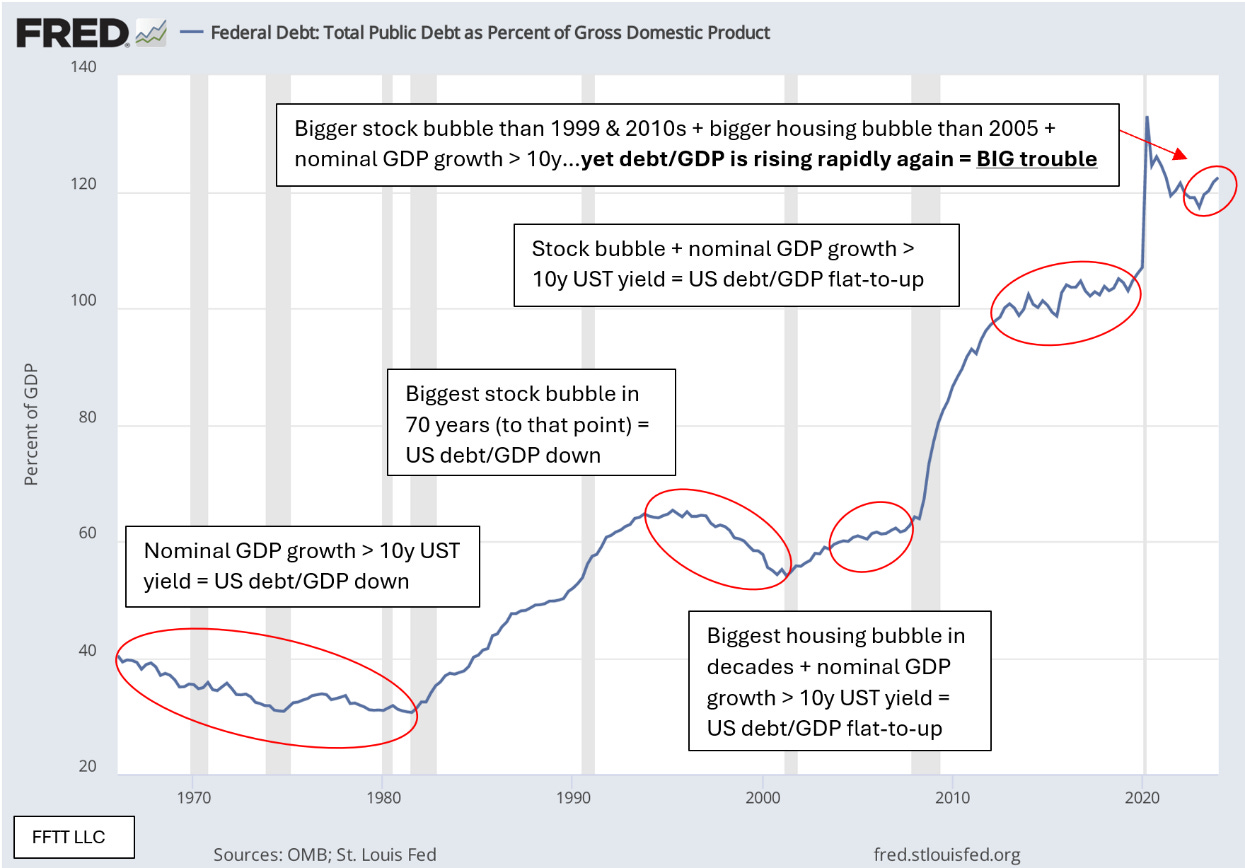

That is not what’s happening. As the following chart shows, the usual effect of the stock market and housing bubbles is to produce tax receipts that help reduce the deficit and public debt.

The Overton window on discussing the perilous condition of the US Debt/GDP ratio has moved to where it is now drawing regular column ink in the Wall Street Journal.

Will debt sink the American empire? – 6/21/24

Will Debt Sink the American Empire? – WSJ

…followed by this article:

The national debt crisis is coming – 6/25/24 (via JT)

The National Debt Crisis Is Coming – WSJ

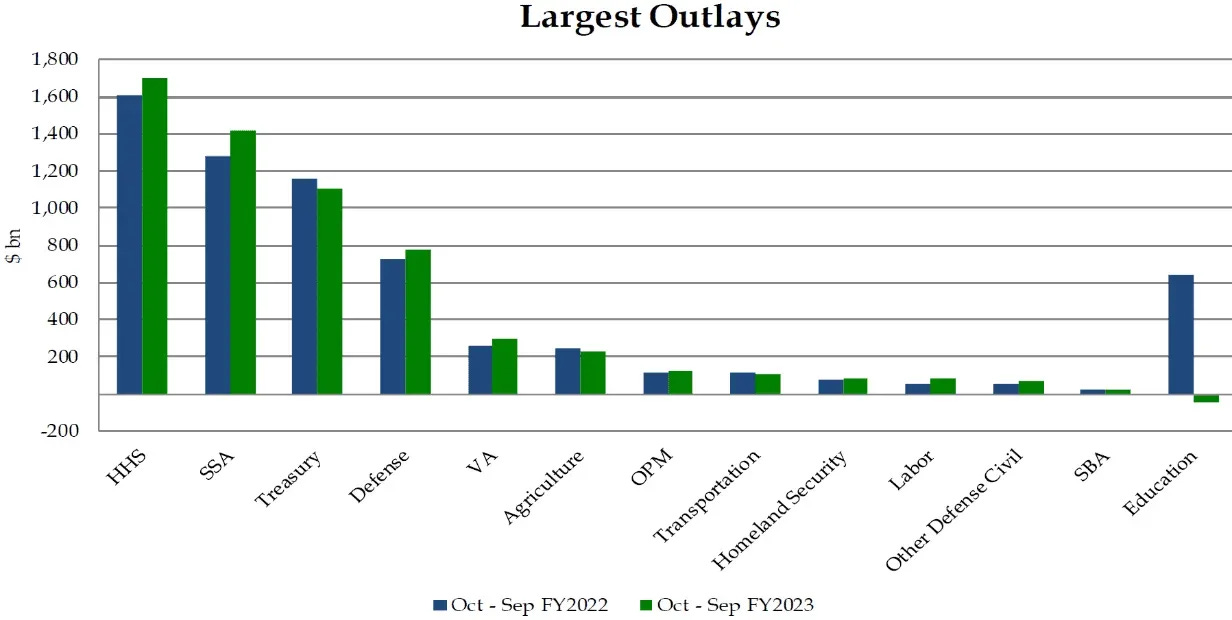

The US economy is NOT deleveraging at all. It is running ever-larger deficits because total outlays per annum exceed tax revenues by an increasing margin.

The US government is supposed to be a AAA borrower of undoubted creditworthiness. Except… it isn’t

Data from the Congressional Budget Office’s (CBO) “Changes in CBO’s Projections of the 10-year Deficit Since February 2024” state the following:

“Changes in CBO’s Budget Projections: In CBO’s current projections, the deficit for 2024 is $0.4 trillion (or 27 percent) larger than it was in the agency’s February 2024 projections, and the cumulative deficit over the 2025– 2034 period is larger by $2.1 trillion (or 10 percent). The largest contributor to the cumulative increase was the incorporation of recently enacted legislation into CBO’s baseline, which added $1.6 trillion to projected deficits. That legislation included emergency supplemental appropriations that provided $95 billion for aid to Ukraine, Israel, and countries in the Indo-Pacific region. By law, that funding continues in future years in CBO’s projections (with adjustments for inflation), boosting discretionary outlays by $0.9 trillion through 2034.”

A company typically has a borrowing covenant requiring periodic performance reports compared to budget or forecast. A borrower who, within one quarter of taking a loan, reported a variance to budget of 27% would straight-away be put on credit watch.

The US is on credit watch.

Review of Where We Are

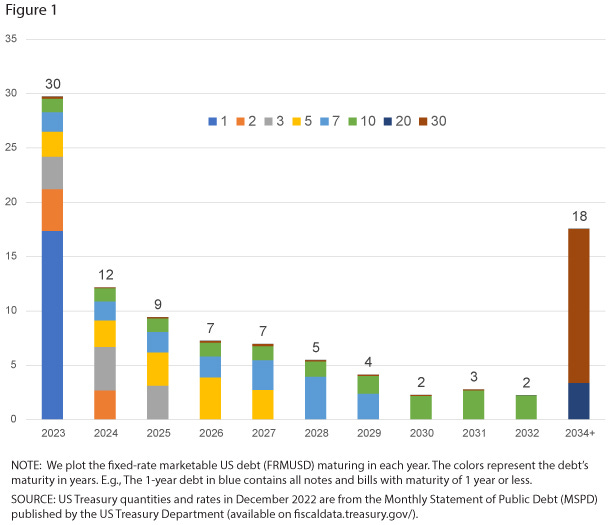

The US has $35T of debt outstanding (growth since chart below):

The world has over $350T of debt outstanding. None of this is a problem if, when it comes due, it can be refinanced or rolled over.

The US has a privileged position of being the world’s reserve currency. The Federal Reserve can print money: makeup money out of thin air by simply creating credit in the accounts of the large banks who can then, if required, purchase as much government debt as is needed to finance the growing deficits.

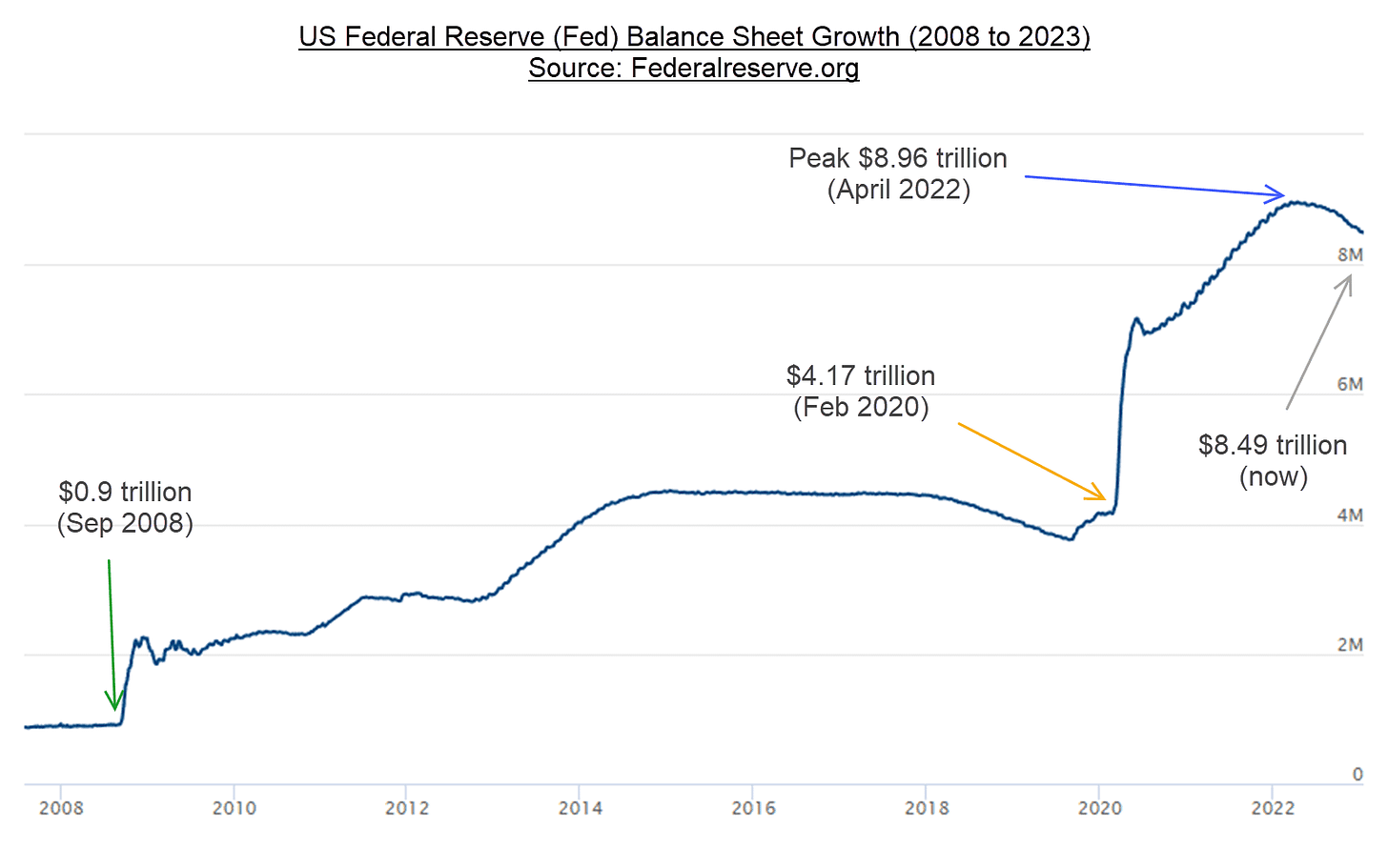

Through QE, the Fed has pumped over $8T of cash into the economy since the global financial crisis:

Where did it get the money to do that? From the Treasury through internal plumbing using the TGA (Treasury General Account is the government’s own bank account where it collects revenues and disburses them for various purposes) and the RRP (Reverse Repo Account is the securities account used by the government to buy and sell, lend and borrow securities with the market). Left pocket, right pocket. Smoke and mirrors.

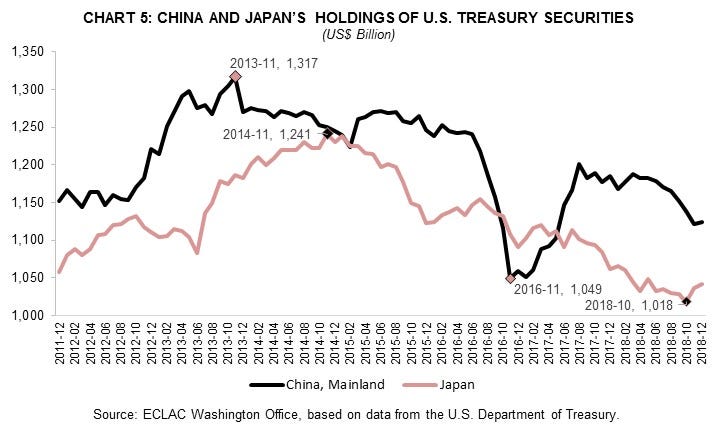

The rest of the world does not quite have this flexibility because they cannot print USD. As the primary currency of trade, the rest of the world cannot print USD to buy the things it needs to buy in USD. It has to sell USD assets.

Since Bretton Woods, the US has been creating trade deficits by buying imports in exchange for USD. So, USD has been its primary export. Foreign buyers for USD have essentially been on strike since 2014:

Let’s Forgive the $8T

What would happen if Janet Yellen just called Jay Powell, and they agreed that the Fed would cancel the $8T of Treasury debt it currently holds on its balance sheet?

Who would be harmed by that?

What is supposed to happen is as follows:

It is inflationary. Why? When the Fed bought that debt through QE, it pumped $8T of cash into the economy. That cash was supposed to stimulate the economy - and did. It turns something that was supposed to be a monetary exercise into more fiscal policy.

If the Fed holds debt issued by the Treasury, it buys it with cash supplied by the Treasury. If it then cancels that debt, it is as if the Treasury sent that cash directly into the economy. This is fiscal policy.

It also creates a terrible incentive for profligate politicians to continue spending more than they raise in taxes - a moral hazard (if there are any morals left in politicians to undermine…)

It is not clear who is harmed, though.

Back to Leviticus

The notion of re-tasking debtors to more productive activities parallels the forgiveness of government debt.

The growing burden of interest the government owes is beginning to crowd out more productive uses of government spending.

Pursuing the kind of industrial policy set out in the Inflation Reduction Act, giving grants to manufacturers to incentivize them to locate semi-conductor chips production in the US, facilitating and expediting the build-out of nuclear capacity, giving tax credits to renewable energy developers, all cost money.

All, arguably, are better uses of tax dollars than servicing the Treasury’s debt.

If the economy's long-term growth exceeds the long-term rate of interest on government debt, then there is hope that the economy can service the debt and make other, more productive investments at the same time. That is not the case right now.

Forgiving over 20% of the outstanding debt—$8 T of the $35T currently out there—would be a good start. Is it worth signaling to the political class that they have a get-out-of-jail-free card? Is it worth the risk of inflation?

Probably.

I’m trying to move the Overton Window a bit further.

Takeaways

Debt forgiveness is not unusual

It can be a productive way to clean house and redirect debtors’ energies

It is not necessarily unfair in a normal interest rate environment

Its frequency should be rare - every 50 years, maybe

It is worth the risks of inflation

It is only a recognition of the inevitable restructuring needed

Politicians will continue to spend unless reigned in by voters

Downsizing the government debt will provide a signal to voters that there is a path back to a more manageable public debt burden

If the debt continues to grow, it will crowd out most other government priorities

Left-pocket/right-pocket monetary policy cannot continue on its current path.

Actually, you are talking about the Fed forgiving $8T in debt. But the USA has $34.6T in total debt outstanding, right? So, still $26.6T to continue rolling over. What's the "right" amount of debt for the USA to have?

Good article. I'll point out that politicians are profligate spenders only because voters elect them to do that. Everybody likes free stuff. Nobody likes taxes.