Welcome to Macro Mashup, the weekly newsletter that distills the content from key voices on macroeconomics, geopolitics, and energy in less than 7 minutes. Thank you for subscribing!

Macro Mashup aims to bring together the greatest minds in Finance and Economics who care deeply about current U.S. and international affairs. We study the latest news and laws that affect our economy, money, and lives, so you don't have to. Tune in to our channels and join our newsletter, podcast, or community to stay informed so you can make smarter decisions to protect your wealth.

Macro Snapshot/Current News

Tariffs continue to be in the news (see the short interview I gave to a local Long Island radio station this week, Great Shares below), as Trump doubles down on threats and promises.

Let’s take a look at the biggest challenge he faces.

China Holds Most of The Cards

It is fashionable to frame geopolitical contests in strongman terms. Here’s the lineup: Trump vs. Putin and Xi.

So far, Xi and Putin are winning. It's depressing, right?

The West grew fat and prosperous after the Cold War, thanks to cheap commodities, low-cost manufacturing, and low interest rates.

Russia provided cheap commodities. China provided cheap manufacturing.

The problems with outsourcing manufacturing to China were that the West hollowed out its manufacturing base, lost jobs, had its intellectual property stolen, and became dependent on China.

Nowhere is this dependency more apparent than in the U.S.’s defense supply chains. During President Trump’s first term, a report was prepared highlighting the urgency of this situation:

The following chart is from that report:

How are you supposed to go to war with an adversary that supplies so much of your key defense systems?

Raytheon's CEO has said that while we can de-risk our supply chain with China, we cannot decouple.

Macroeconomic researcher Luke Gromen points out that while China has been attempting to lock up resource supply by pursuing its Belt and Road Initiative (BRI) in Africa, it has been pursuing a slightly different BRI with the U.S.

Instead of continuing to recycle its trade surpluses with the U.S. into U.S. Treasuries, it has been buying the NASDAQ 100.

The trend is apparent from this chart produced by the St. Louis Federal Reserve:

The green line is negative ($23.6 trillion negative) and measures the amount of U.S. assets owned by the Rest of the World vs. the amount of assets the U.S. owns in other countries.

This shows that trade surpluses - mainly China’s have been reinvested back in the US in the form of investment into NASDAQ 100 stocks.

If the U.S. succeeds in antagonizing China, it may be bad for the NASDAQ 100.

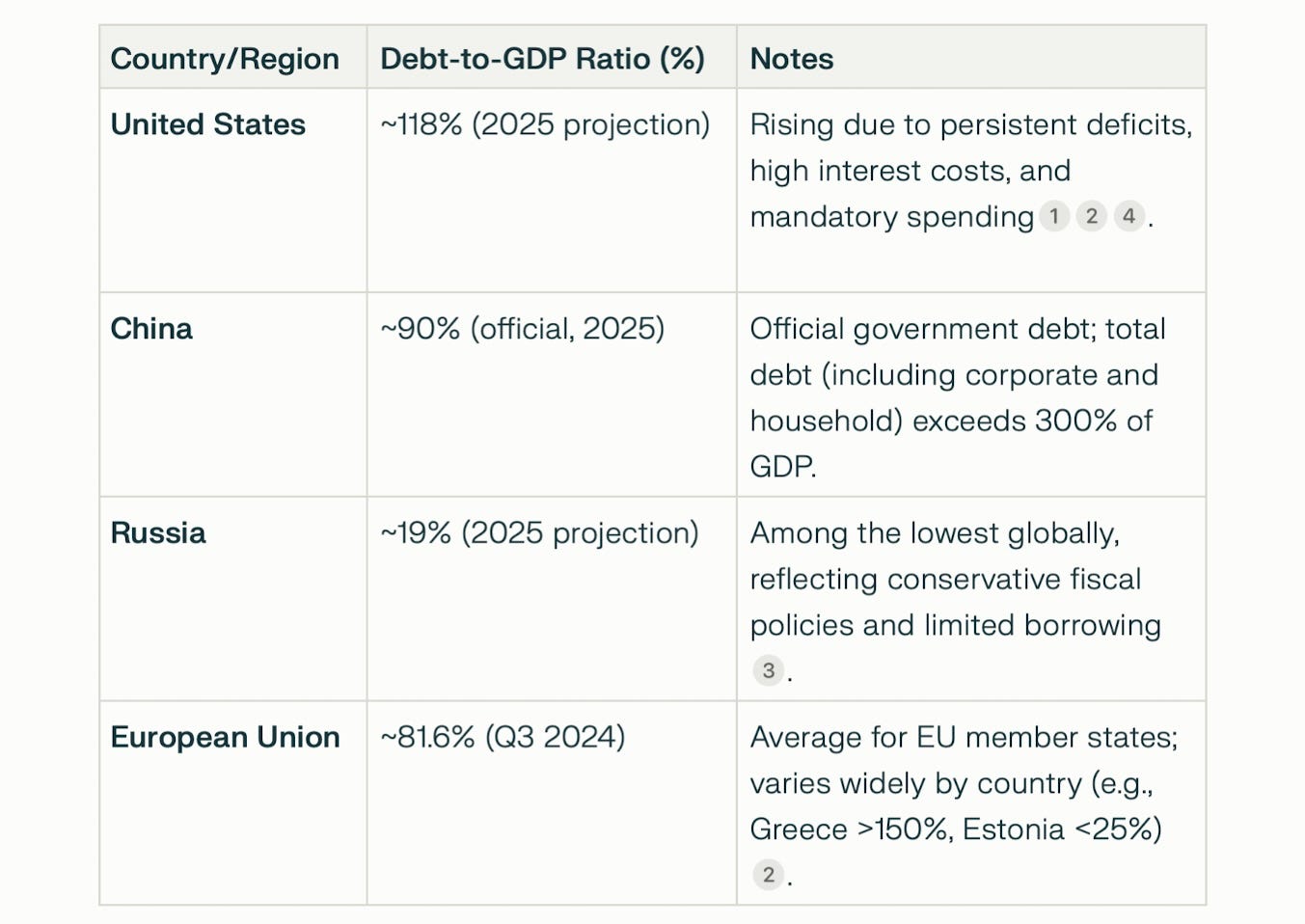

Russia is very much the junior partner in this alliance, but its strength lies in a different area:

Russia’s debt to GDP is less than 20% of the U.S. The Russian economy is not reliant on foreign creditors to fund its economy. It could pay off its external debt in one year.

It relies on sales of its commodities - notably oil and gas - to fund its economy. China is happy to buy the much-needed resources at a discount.

Russia also helps China in its struggle against the U.S. by pressing the war in Ukraine, undermining the economies of the EU, and creating geopolitical problems for the U.S. - Trump has not ended the war in 24 hours as he promised.

Here’s the overview of Global Defense Spending, per IISS The Military Balance 2025.

The purchasing power parity (PPP) adjustment reflects the lower input costs to China and Russia producing their military goods.

But China Does Have Some Challenges

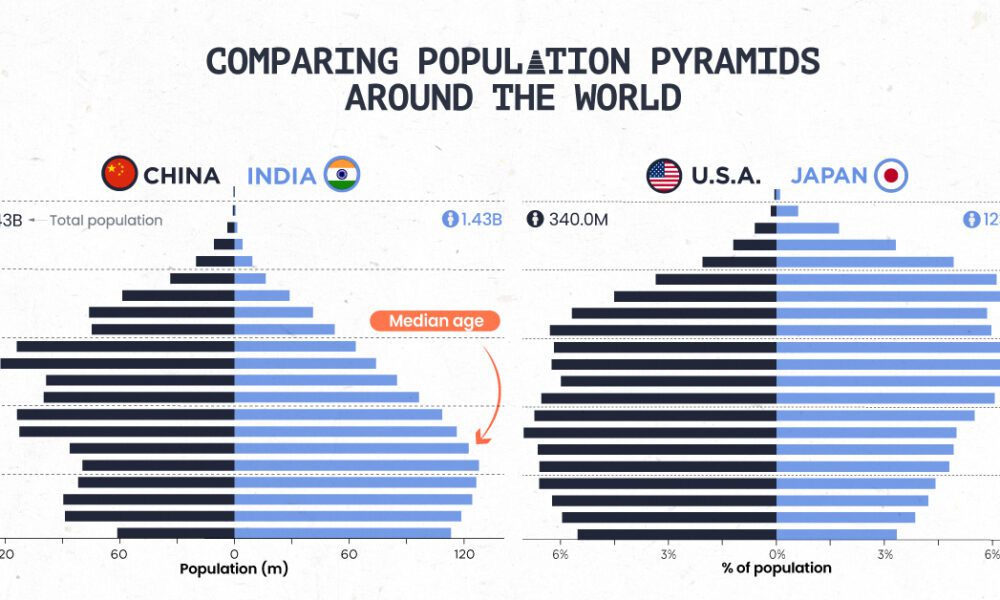

These charts show India's relative demographic advantage over China and the U.S. over Japan. The U.S. is also relatively healthy compared to China, mainly because it industrialized more slowly than other countries.

When countries industrialize and the populations shift to cities, the economic advantage provided by large families (free labor) disappears, and children become more liabilities than assets.

China committed an act of extreme self-harm with its one-child policy.

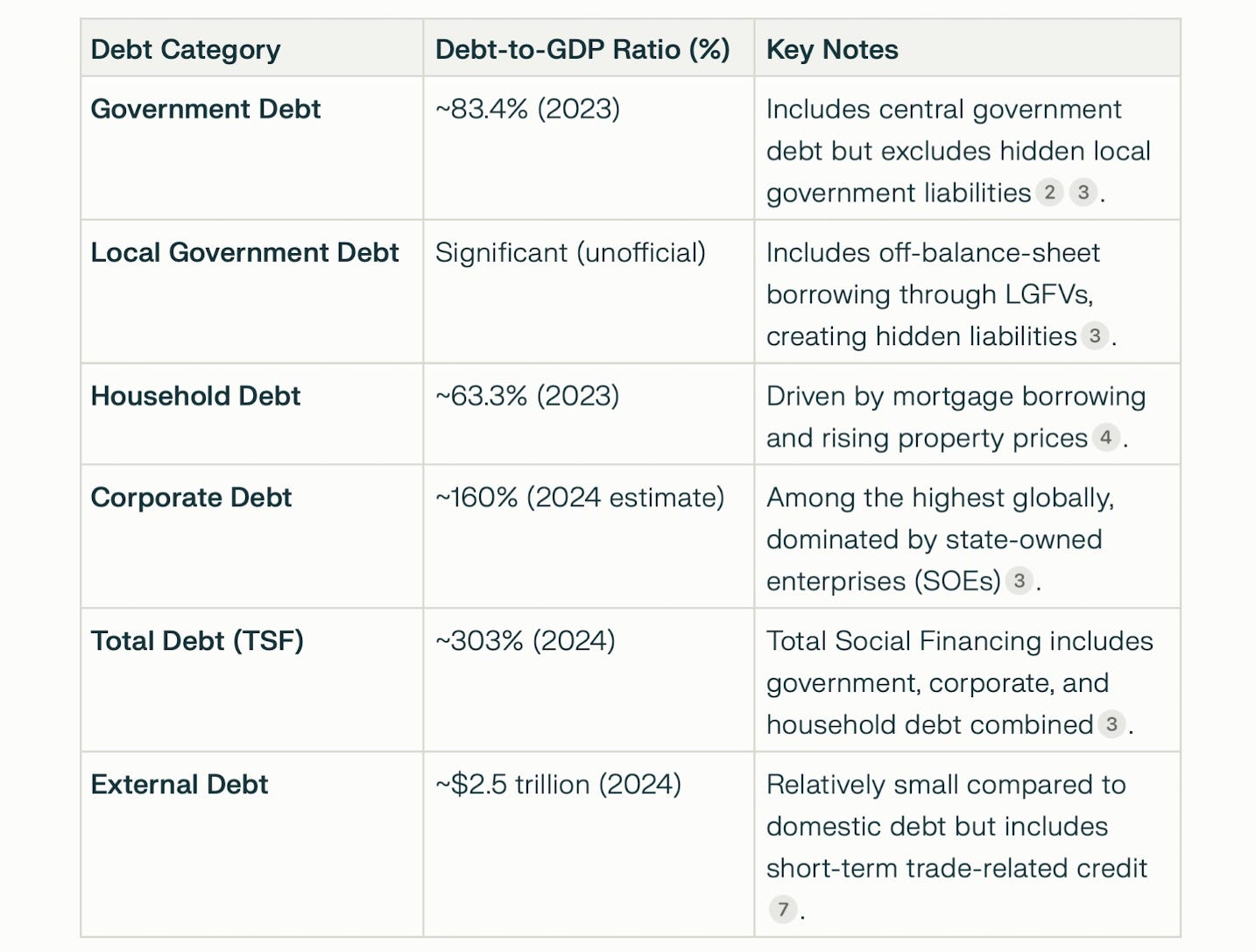

Economies grow as their populations grow. China is now not growing fast enough to sustain the debt it has built up through some of its investment-led growth - primarily property that is way more than it can productively occupy.

How Does This Play Out?

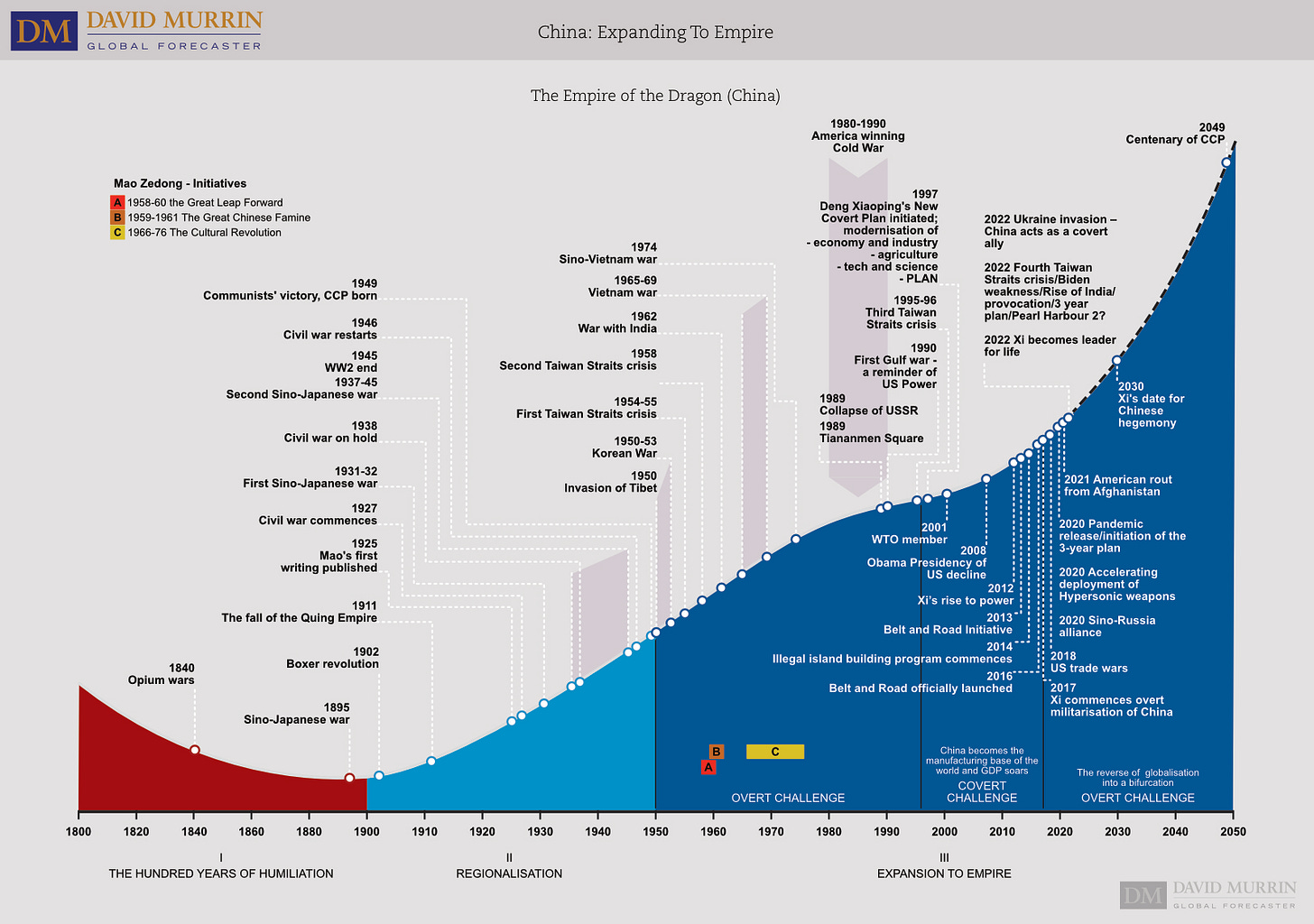

Global commentator David Murrin believes China faces a choice: continue to follow the arc of an ascending global power, acquire territory, and challenge the U.S. militarily in the process, or face inexorable demographic and economic decline. (Sneak preview of an excellent chart to be included in his next book, Breaking the Code of War, release date summer 2025).

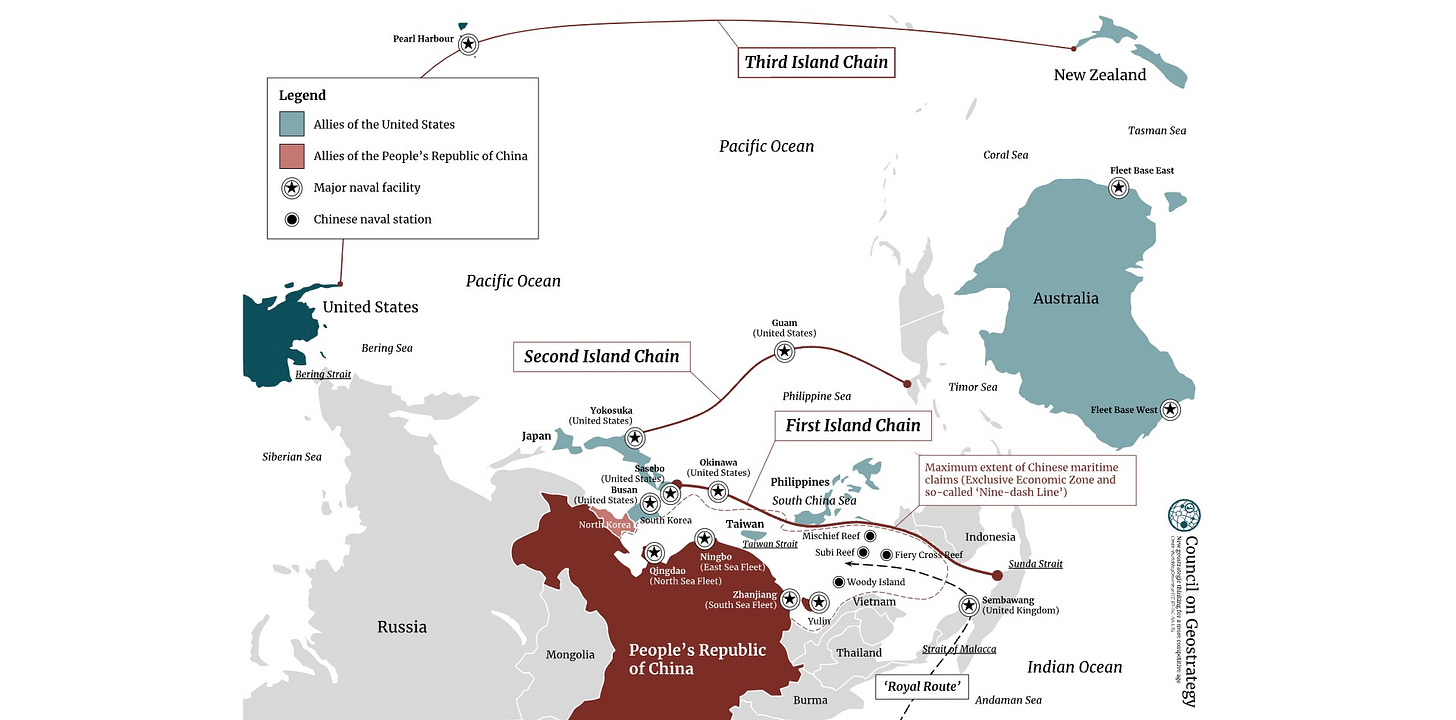

Taiwan is an obvious step, as are the Second and Third Island Chains.

Pushing out to the First Island Chain may not trigger WW3, but the Second Chain almost certainly will. The Third touches Pearl Harbor.

In The Markets

It has been a strong week for precious metals…

…and for those who mine them.

The background to this is, in part, Treasury Secretary Scott Bessent’s remarks (Quote of The Week below) that he will monetize the asset side of the balance sheet for the American people.

It’s not obvious, but, again, according to Luke Gromen, the implication is that the US may be preparing to mark to market its 261.5 million ounces of gold held at $42. That would magically create an immediate $754 billion balance in the Treasury’s balance sheet - money printing of a different kind: an unrealized gain realized.

If it signaled this in advance, the gold price may rise beyond the $2,850 implicit in this calculation.

- The 10-year Treasury yield has bounced around a lot, reflecting volatile reactions to tariff and geopolitical comments.

- The S&P 500 has been trading within a reasonably narrow range, still above the 6,000 level. The EURO STOXX 50 - a comparable benchmark for Europe - has traded more positively, presumably reflecting the relatively local reaction to progress on ending the war in Ukraine.

Great Shares

This is from Hofstra, an early morning segment I agreed to at the last minute. It was ostensibly about tariffs but evolved into some sharp questions. (Click on the image.) Before I speak, there is some music—you can scroll forward.

And then, in case you weren’t already feeling a bit unsettled about China, there is this from the new Secretary of State:

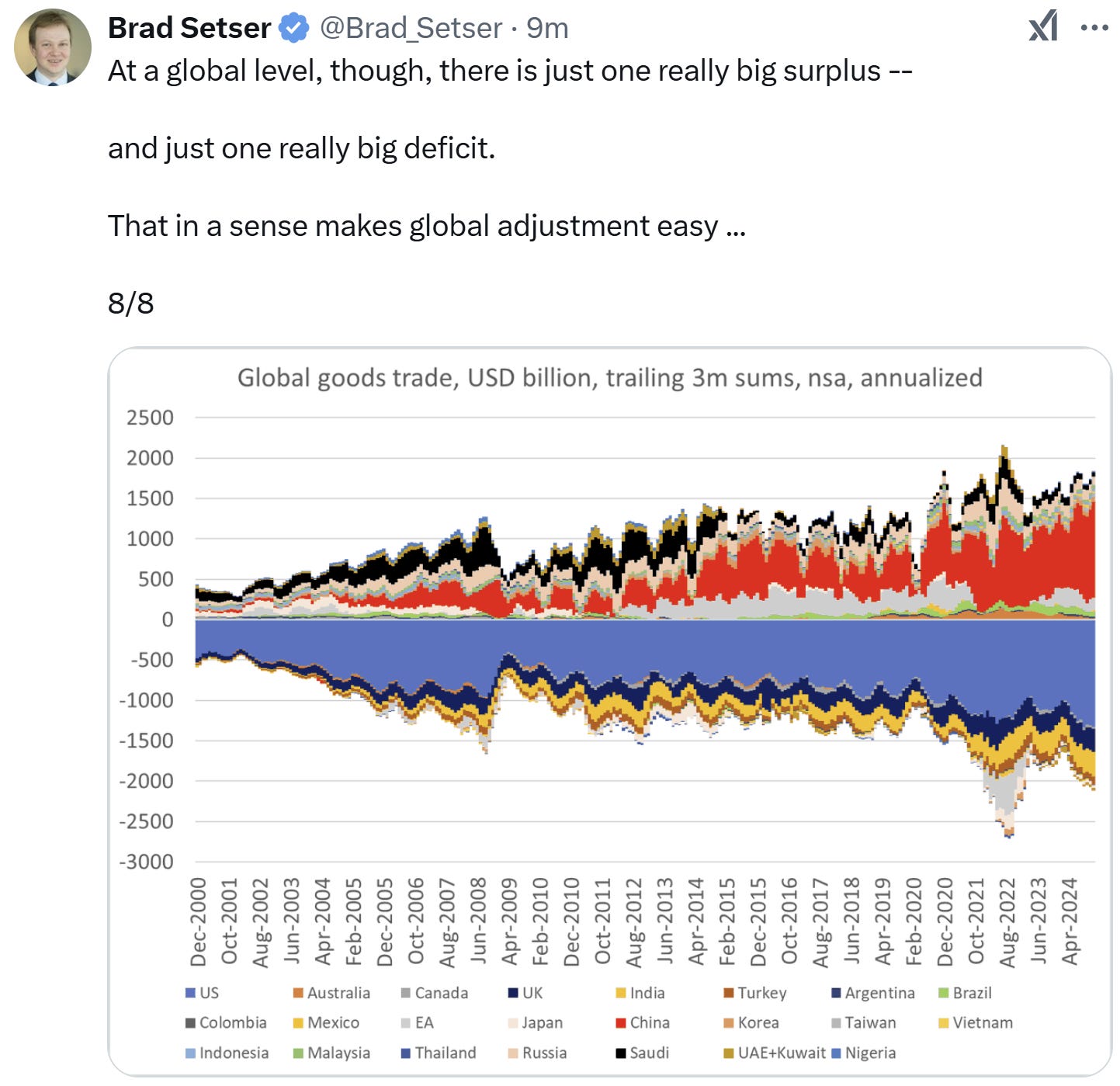

And this from China commentator Brad Stetser:

On The Horizon

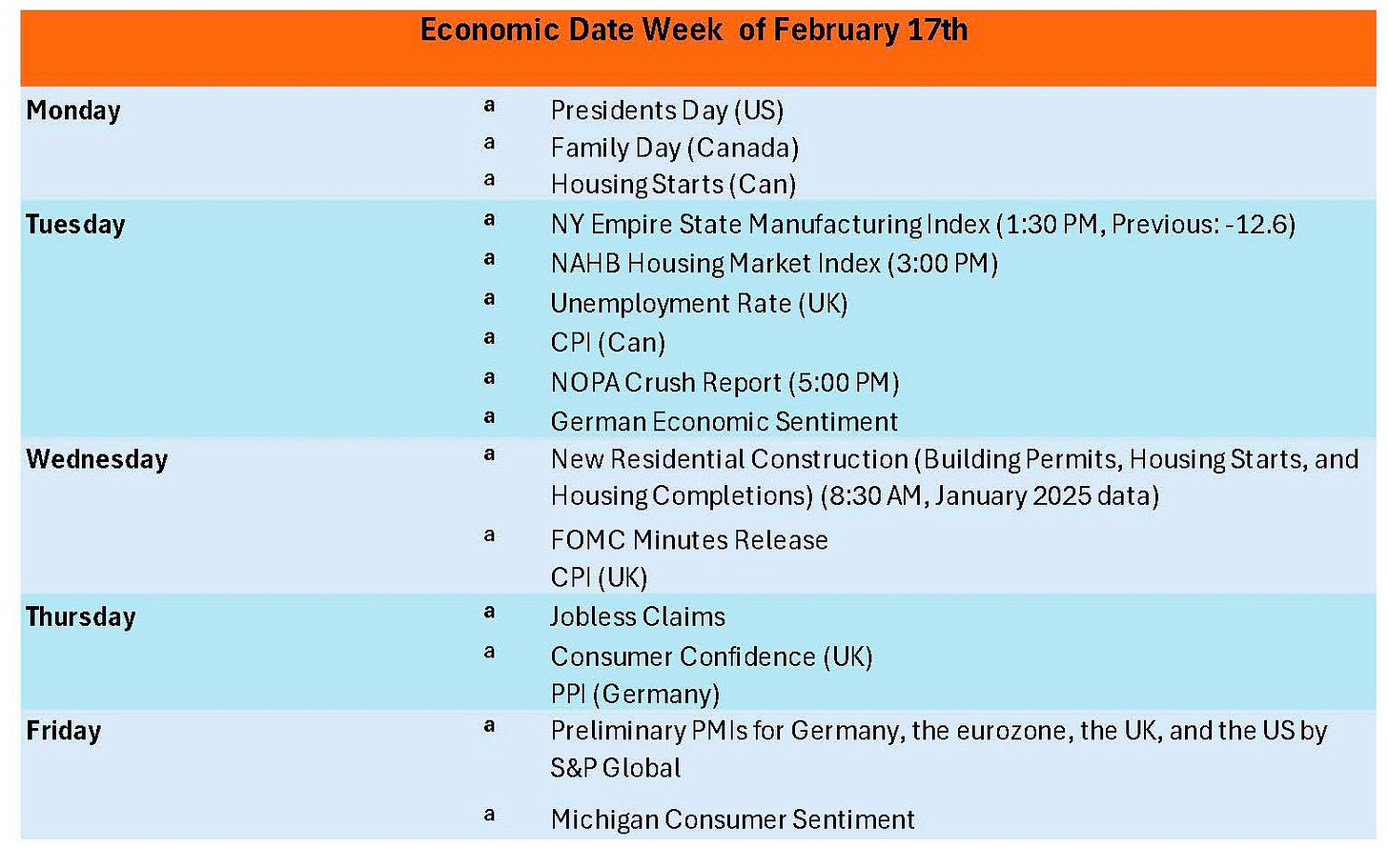

Here are the (curated) key economic events for the week of February 17–21, 2025:

Some (most) of these may not grab your attention, so I am including selective events from Europe and Canada (soon to be…) - for my non-U.S. subscribers.

In case you were wondering about the NOPA Crush Report, it concerns the number of soybeans crushed…

I am focused on the FOMC minutes on Wednesday, which will provide insights into the Fed governors' thoughts.

Quote of The Week

“We’re going to monetize the asset side of the U.S. balance sheet for the American people,” Bessent said. “There’ll be a combination of liquid assets, assets that we have in this country as we work to bring them out for the American people.”

Four Ways To Support MacroMashup

If you are interested in clean energy investment advisory services, book a complimentary call here

If you wish to see even more content from MacroMashup, check out our podcast (the first episode should be posted in next week’s newsletter)!

If you'd like me to be a guest on your podcast or guest blog about clean energy or macroeconomics, send an email to contact@macromashup.com

If you enjoy this newsletter, do me a favor and share it with a friend by clicking on the button below.